Active management in the ETF space offers benefits over passive strategies by allowing managers to adjust positions to capture relative value opportunities in credit spreads and industry sectors, as well as permitting diversification during periods of tight valuations. When spreads are wide, active managers can reposition the risk profile of the fund to seek higher performance, potentially boosting returns.

Moreover, active managers can leverage their macro and issuerspecific research to help avoid certain issuers and sectors that may pose higher risks. This ability to make informed decisions allows for a more tailored investment strategy. Active managers can also capitalize on smaller issues to help enhance returns due to the liquidity spread premium associated with these opportunities. They can take meaningful positions without owning an outsize percentage of the issue, minimizing market impact when trading. This agility can lead to better performance compared with that of passive funds.

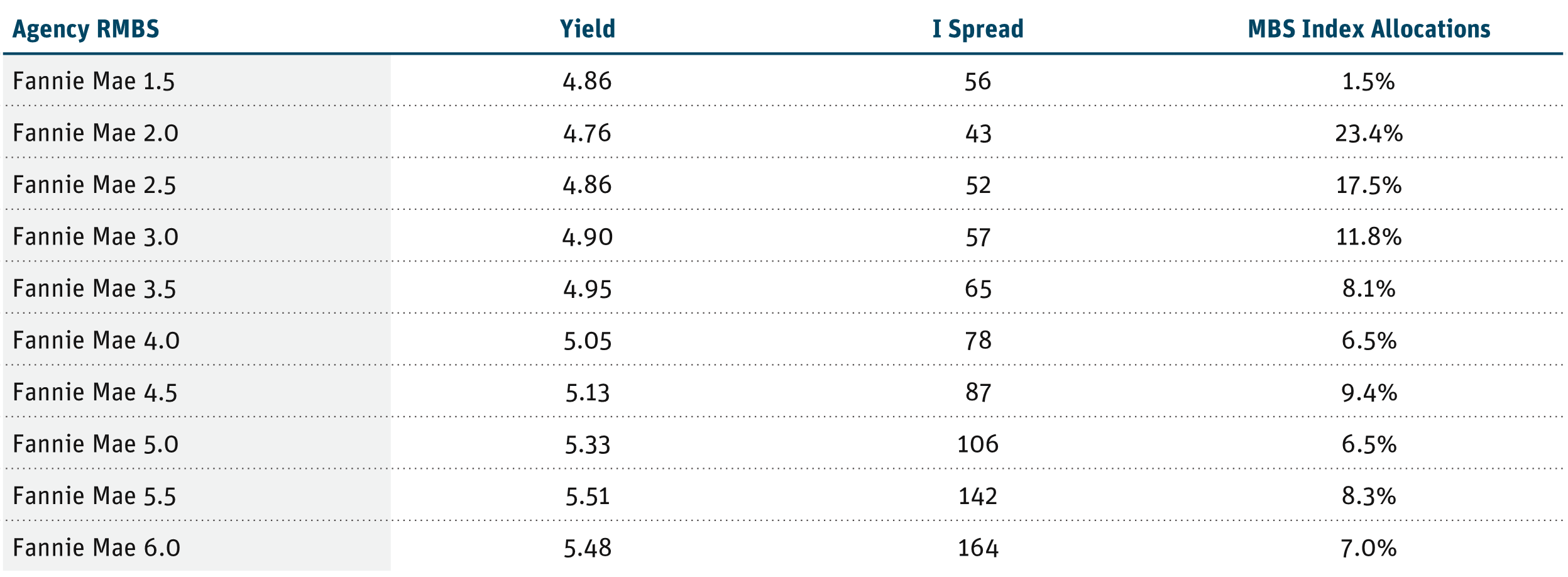

A great example is the opportunity in Agency RMBS, which currently represent value relative to other fixed income sectors – they are relatively cheap, and the healthy housing market ensures strong collateral valuations. As you move up the coupon stack, Agency RMBS are priced to provide higher yields and income. However, passive index managers have higher allocations to bonds loaded up with lowrate mortgages.

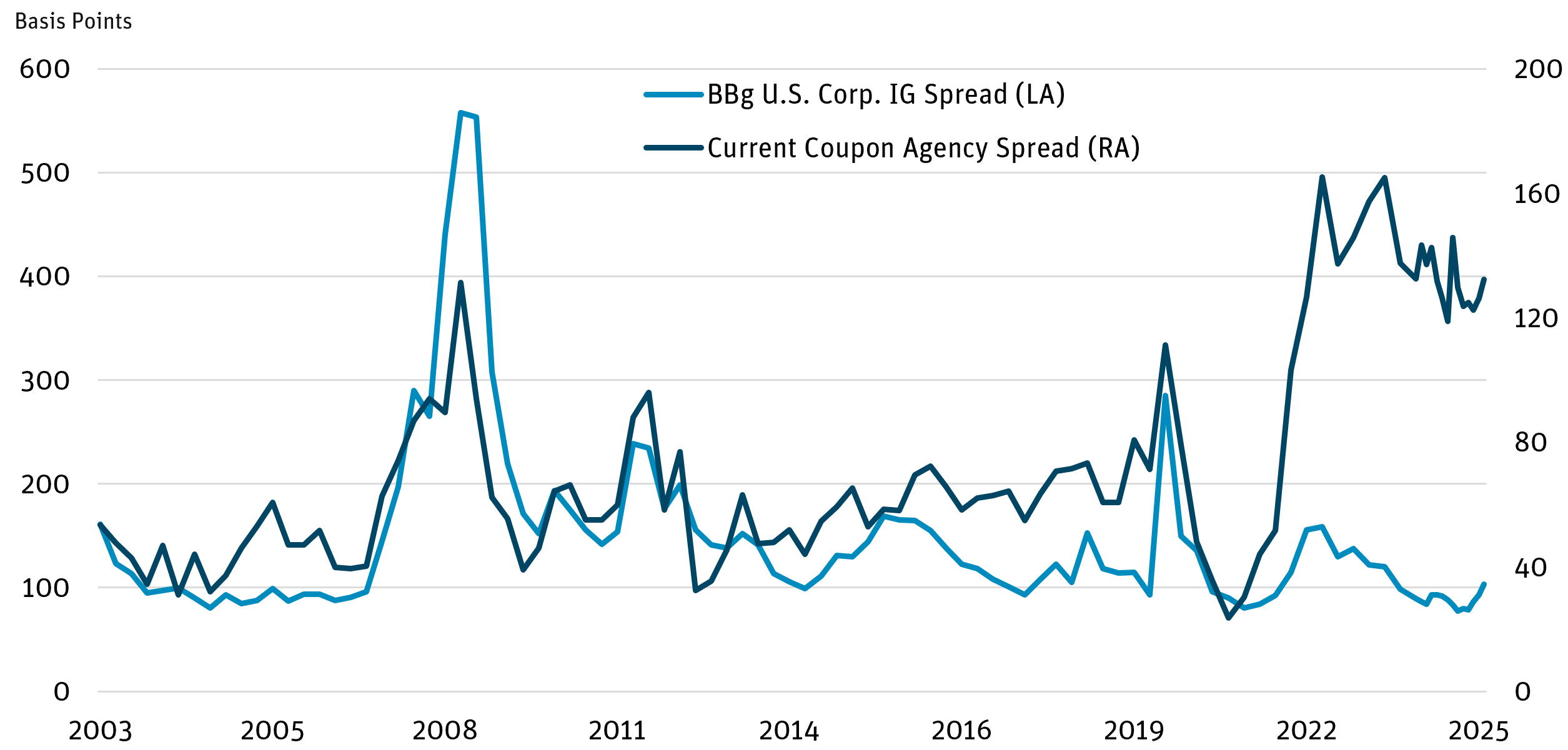

Current Coupon Agency Spread Wider Than IG Corp. Index Spread

Source: Bloomberg, Morgan Stanley Research as of 5/31/25.

Active managers can overweight the higher-coupon bonds, whereas passive managers are handcuffed to the index – leaving yield on the table.

Another example is the premium that securitized credit tends to earn relative to corporate credit over market cycles (see The Securitized Credit Premium whitepaper for more).

Agency RMBS Coupon Stack Opportunity

Source: Bloomberg, BlackRock iShares as of 6/13/25.

Active managers can overweight securitized products to help capture this premium, while passive managers remain sidelined.

We believe that this may be particularly attractive now because the risk of investing in securitized credit has decreased over the past decade due to increasing regulation and tightening underwriting standards.

Securitized Credit Has Historically Outperformed Corporate Credit

Source: BofA Global Research as of 5/31/25.

Fund managers that go off-index also have the advantage of managing the duration and callability characteristics of their portfolios. They can avoid or sell issuers facing credit challenges or downgrade risks, thereby minimizing risk. Additionally, active managers can overweight/ underweight issuers based on their informed view, whereas passive managers are constrained by their index. This strategic positioning allows for a more responsive and potentially more profitable investment approach.

DEFINITIONS AND DISCLOSURES

Agency Mortgage-Backed Securities (AMBS): Securities issued or guaranteed by the U.S. government or a GSE.

Basis Point (bps): One hundredth of one percent and is used to denote the percentage change in a financial instrument.

Bloomberg U.S. Aggregate Bond Index: An unmanaged index that measures the performance of the investment-grade universe of bonds issued in the United States. The index includes institutionally traded U.S. Treasury, government sponsored, mortgage and corporate securities.

Bloomberg U.S. Corporate Investment Grade Index: An index that measures the investment grade, fixedrate, taxable corporate bond market. It includes USD-denominated securities publicly issued by U.S. and non-U.S. industrial, utility and financial issuers.

Bloomberg U.S. Mortgage-Backed Securities (MBS) Index: An index that tracks fixed-rate agency mortgage-backed pass- through securities guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC).

Current Coupon: Refers to a security that is trading closest to its par value without going over par. In other words, the bond’s market price is at or near to its issued face value.

Mortgage-Backed Security (MBS): A type of asset-backed security which is secured by a mortgage or collection of mortgages.

Spread: The difference in yield between a U.S. Treasury bond and a debt security with the same maturity but of lesser quality.

Opinions expressed are as of 5/31/25 and are subject to change at any time, are not guaranteed, and should not be considered investment advice.

Investing involves risk; principal loss is possible. Investments in debt securities typically decrease when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower-rated and nonrated securities present a greater risk of loss to principal and interest than do higher-rated securities. Investments in asset-backed and mortgage-backed securities include additional risks that investors should be aware of, including credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Derivatives involve risks different from — and in certain cases, greater than — the risks presented by more traditional investments. Derivatives may involve certain costs and risks such as illiquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lead to losses that are greater than the amount invested. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. The Fund may use leverage, which may exaggerate the effect of any increase or decrease in the value of securities in the Fund’s portfolio or the Fund’s net asset value, and therefore may increase the volatility of the Fund. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are increased for emerging markets. Investments in fixed-income instruments typically decrease in value when interest rates rise. The Fund will incur higher and duplicative costs when it invests in mutual funds, ETFs and other investment companies. There is also the risk that the Fund may suffer losses due to the investment practices of the underlying funds. For more information on these risks and other risks of the Fund, please see the Prospectus.

ETFs may trade at a premium or discount to NAV. Shares of any ETF are bought and sold at market prices (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Angel Oak Funds. This and other important information about each Fund is contained in the Prospectus or Summary Prospectus for each Fund, which can be obtained by calling 855-751-4324 or by visiting www.angeloakcapital.com. The Prospectus or Summary Prospectus should be read carefully before investing.

Index performance is not indicative of Fund performance. Past performance does not guarantee future results. Current performance can be obtained by calling 855-751- 4324.

The Angel Oak Funds are distributed by Quasar Distributors, LLC.

© 2025 Angel Oak Capital Advisors, which is the adviser to the Angel Oak Funds.