Angel Oak believes that the strength of housing valuations, shortages in housing stock inventory, and the buildup of homeowner’s equity relative to mortgage debt are strong tailwinds for mortgages and have created an opportunity for investors in both Agency and Non-Agency residential mortgage-backed securities (RMBS), especially relative to corporate credit. This opportunity is made even more attractive by market technicals that have made RMBS relatively cheap. Angel Oak recommends rotating out of corporate credit allocations and into RMBS.

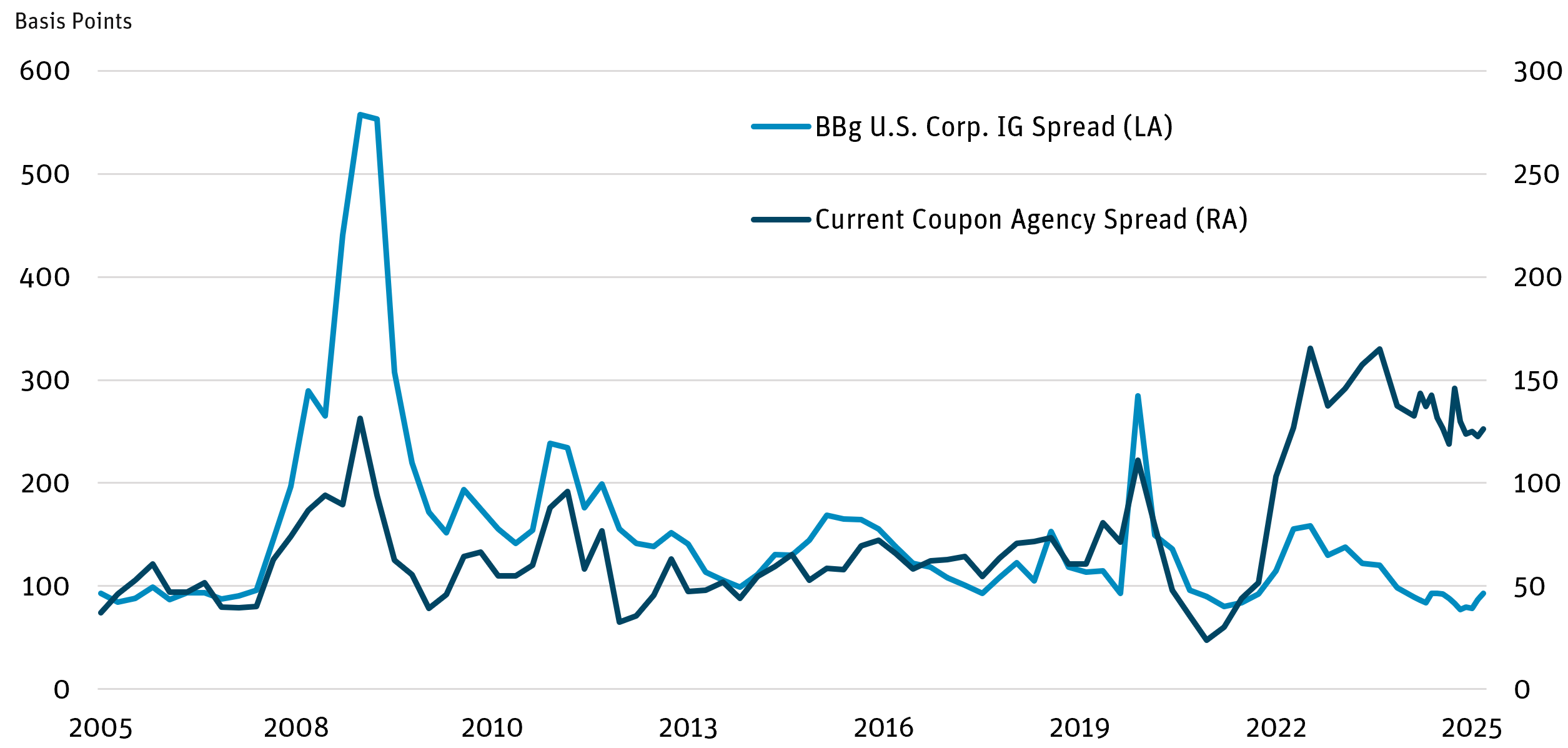

Agency RMBS trade at a spread to government securities to compensate investors for the prepayment risk in the underlying mortgage loan collateral. Spreads on both Agency RMBS and corporate bonds rose dramatically during the Great Financial Crisis (Figure 1), after which both asset classes experienced spread normalization. Spreads on Agency RMBS widened again as the Fed began increasing rates in March 2022, causing banks to sell off this asset class, while corporate bond spreads over government securities were relatively static (Figure 1). This dynamic has created a significant relative value opportunity in Agency RMBS compared with corporate credit.

Figure 1: Current Coupon Agency Nominal Spread Wider Than IG Corp. Index Spread

Source: Bloomberg, Morgan Stanley Research as of 3/31/25.

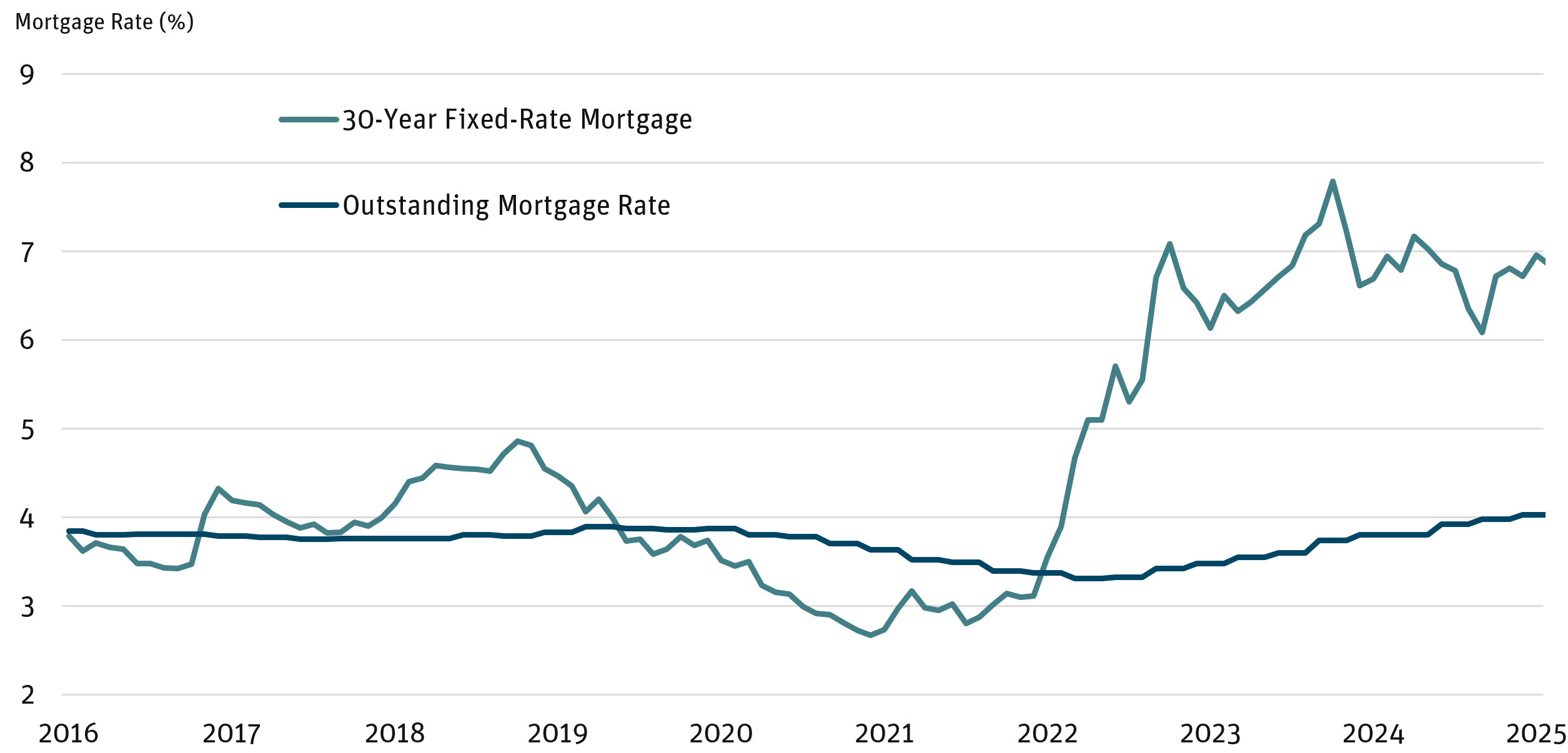

Figure 2: Current vs. Effective Mortgage Rates

Source: Bloomberg as of 3/31/25.

This relative value is even more attractive given the minimal incentive that most borrowers have to refinance their mortgages, which is the primary driver of prepayments in Agency RMBS. Current rates on newly originated Agency-qualifying mortgages are near 7.00%, which is much higher than the average rate of about 4.00% on all outstanding mortgages (Figure 2). The result is that investors in Agency RMBS are getting compensated by a spread that reflects greater prepayment risk than appears to be warranted. The Fed’s most recent internal forecast1 indicates its expectation of a 50-bps decline in the Fed Funds rate throughout 2025, a signal that rates are unlikely to decline substantially enough to create significant refinancing incentives in the residential mortgage space.

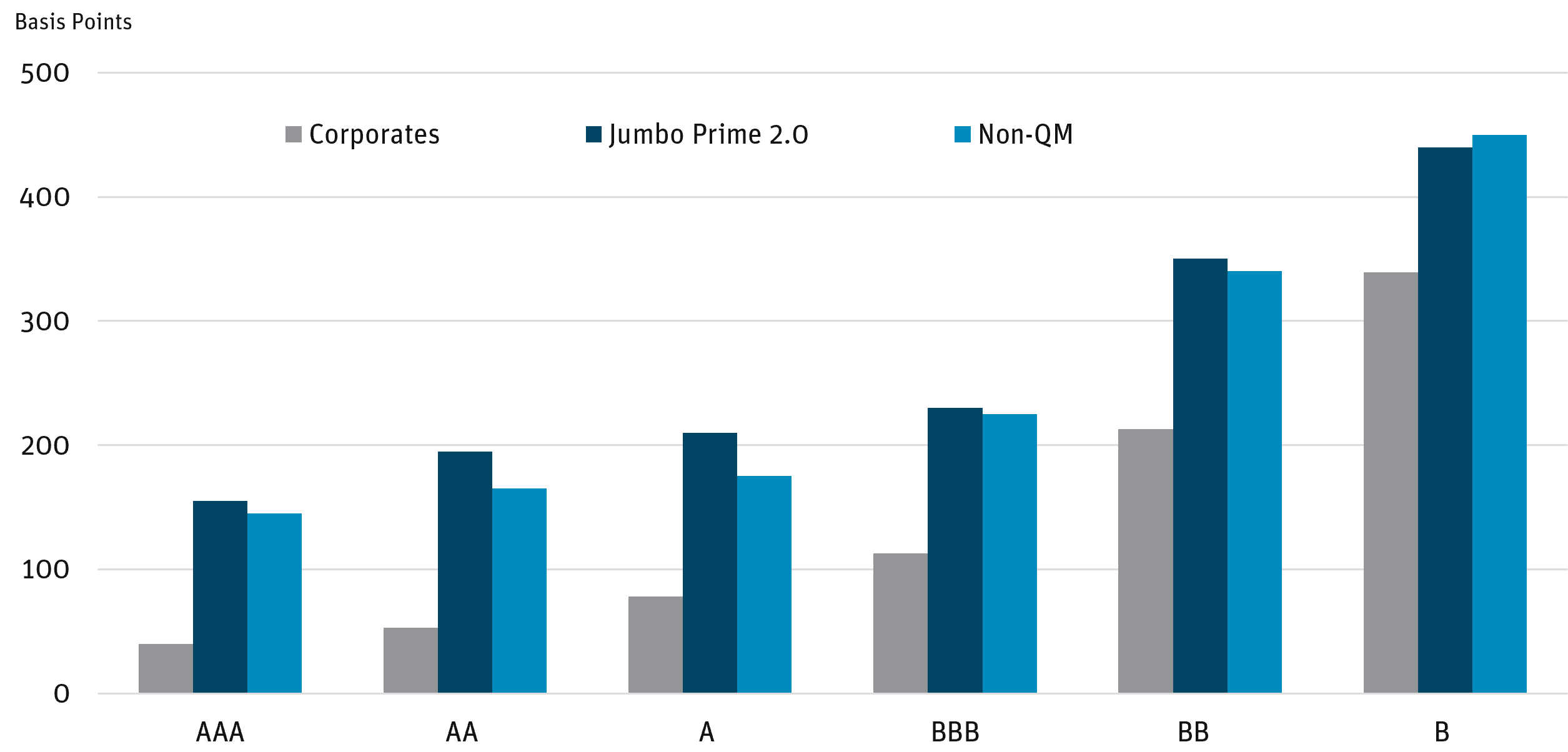

Non-Agency RMBS currently offer significantly higher yield spreads versus similarly rated corporates (Figure 3). We believe current spread levels offer a very attractive entry point into this asset class relative to corporate credit.

In summary, fundamental economic strengths in housing combined with market dislocations in the RMBS space and a favorable rate outlook have created a historic opportunity for investors in both Agency and NonAgency bonds relative to corporate credit.

Figure 3: Non-Agency vs. Corporate Spreads

Source: Bloomberg as of 3/31/25. A

DEFINITIONS AND DISCLOSURES

Agency Mortgage-Backed Securities (AMBS): Securities issued or guaranteed by the U.S. government or a GSE.

Basis Point (bps): One hundredth of one percent and is used to denote the percentage change in a financial instrument.

Delinquencies: Represent a neglect in making required payments on a debt.

Mortgage-Backed Security (MBS): A type of asset-backed security which is secured by a mortgage or collection of mortgages.

Mortgage Credit Availability Index (MCAI): The MCAI is a barometer of the availability of mortgage credit using guidelines from institutional investors who purchase loans through the broker and/or correspondent channels.

Spread: The difference in yield between a U.S. Treasury bond and a debt security with the same maturity but of lesser quality.

Opinions expressed are as of 3/31/25 and are subject to change at any time, are not guaranteed, and should not be considered investment advice.

Investing involves risk; principal loss is possible. Investments in debt securities typically decrease when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower-rated and nonrated securities present a greater risk of loss to principal and interest than do higher-rated securities. Investments in asset-backed and mortgage-backed securities include additional risks that investors should be aware of, including credit risk, prepayment risk, possible illiquidity and default, as David Wells Chief Portfolio Strategist Rob McDonough Director, Senior Strategist well as increased susceptibility to adverse economic developments. Derivatives involve risks different from — and in certain cases, greater than — the risks presented by more traditional investments. Derivatives may involve certain costs and risks such as illiquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lead to losses that are greater than the amount invested. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. The Fund may use leverage, which may exaggerate the effect of any increase or decrease in the value of securities in the Fund’s portfolio or the Fund’s net asset value, and therefore may increase the volatility of the Fund. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are increased for emerging markets. Investments in fixed-income instruments typically decrease in value when interest rates rise. The Fund will incur higher and duplicative costs when it invests in mutual funds, ETFs and other investment companies. There is also the risk that the Fund may suffer losses due to the investment practices of the underlying funds. For more information on these risks and other risks of the Fund, please see the Prospectus.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Angel Oak Funds. This and other important information about each Fund is contained in the Prospectus or Summary Prospectus for each Fund, which can be obtained by calling 855-751-4324 or by visiting www.angeloakcapital.com. The Prospectus or Summary Prospectus should be read carefully before investing.

Index performance is not indicative of Fund performance. Past performance does not guarantee future results. Current performance can be obtained by calling 855-751- 4324.

The Angel Oak Funds are distributed by Quasar Distributors, LLC.

© 2025 Angel Oak Capital Advisors, which is the adviser to the Angel Oak Funds.