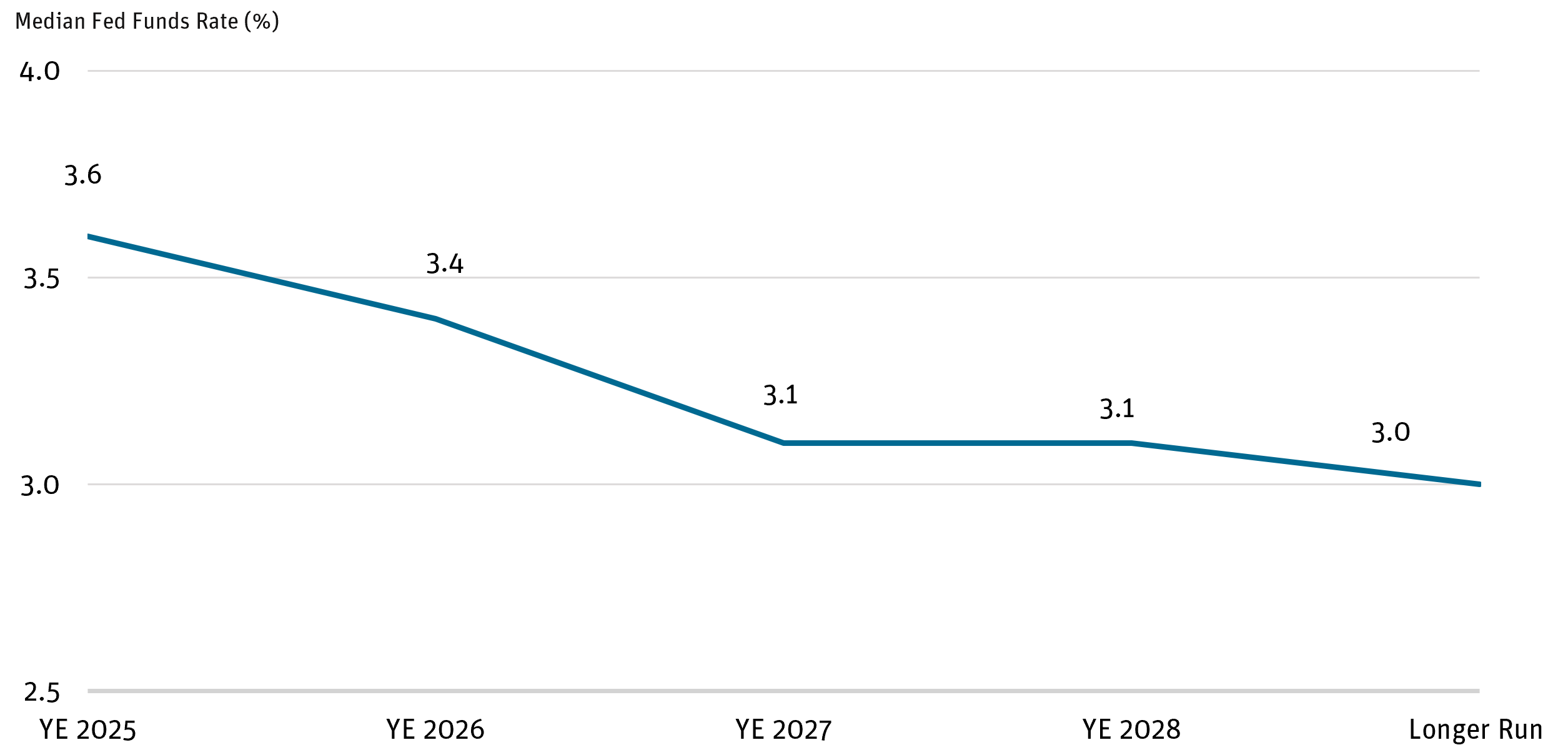

While AAA-rated collateralized loan obligations (CLOs) performed well for risk-averse investors from 2022 to 2024, Angel Oak believes that recent market developments suggest it may be time to pivot—locking in higher yields and diversifying short-duration allocations. The Federal Reserve projects that monetary policy will lead to lower short-term rates (Figure 1), while recent geopolitical uncertainty has increased the likelihood of an economic slowdown. This combination could create a two-pronged stress scenario for AAA CLOs: diminished floating-rate coupons and income paired with potential spread widening and resulting price depreciation.

Figure 1: FOMC Summary of Economic Projections

Source: Federal Reserve Board as of 9/17/25

Last year, strong ETF inflows were a key driver of demand for AAA-rated CLO tranches, as investors sought fixed-income strategies that had performed well during the rate hikes of 2022 and 2023. Seeking yield enhancement over five-year Treasuries, many investors turned to ETFs offering exposure to high-quality CLO tranches. This surge in demand led to significant outperformance in the five-year floating-rate sector but limits the opportunity set for 2025 and beyond.

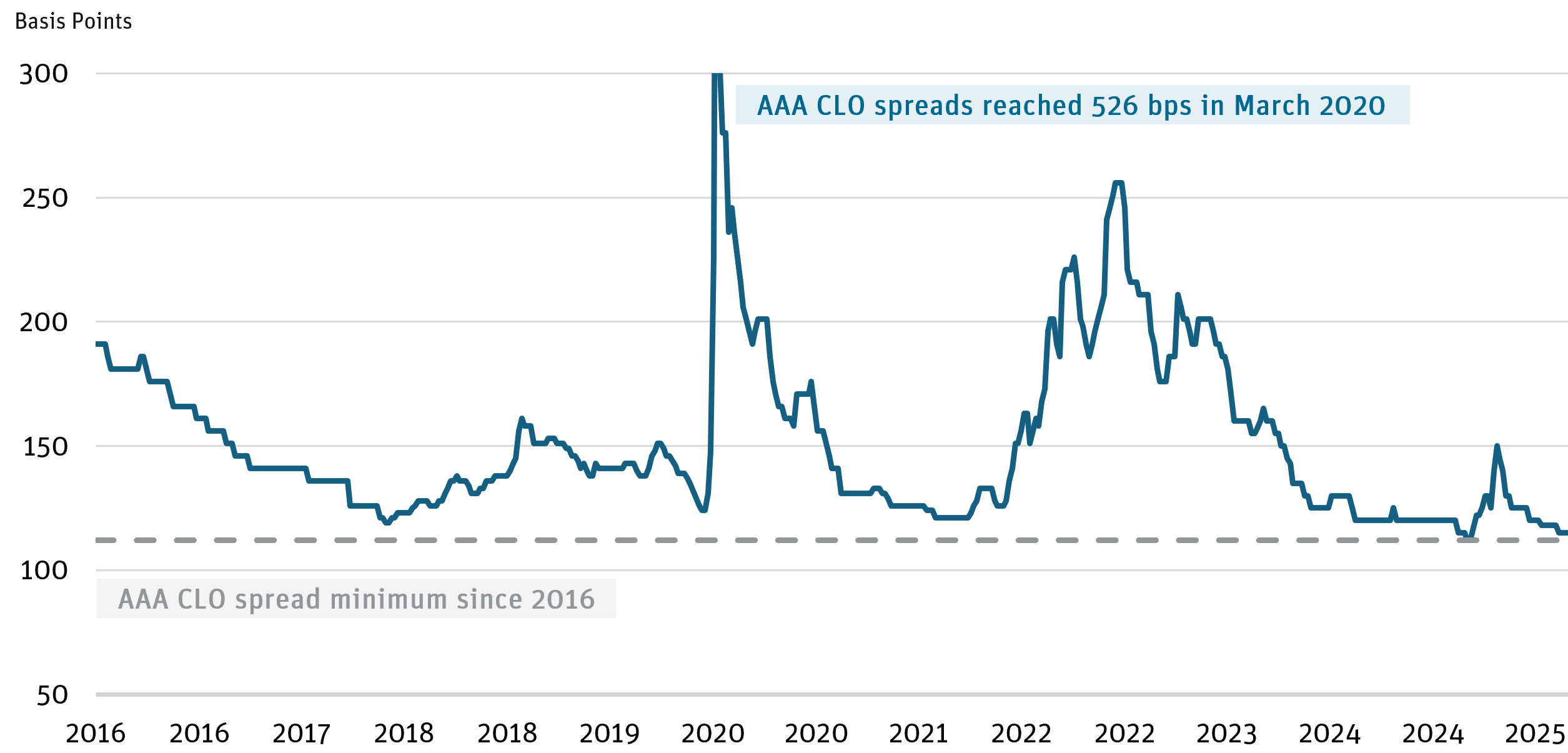

Today’s elevated geopolitical uncertainty and associated market volatility have raised the probability of economic turbulence. This could prompt outflows from investors rotating back into money market funds, a dynamic that may lead to spread normalization in AAA CLOs. Spreads in this asset class have been in the 0.40th percentile since 2016, placing them near all-time tights (Figure 2).

Figure 2: AAA CLO Spreads

Source: Bank of America Historical Spreads Report as of 9/26/25.

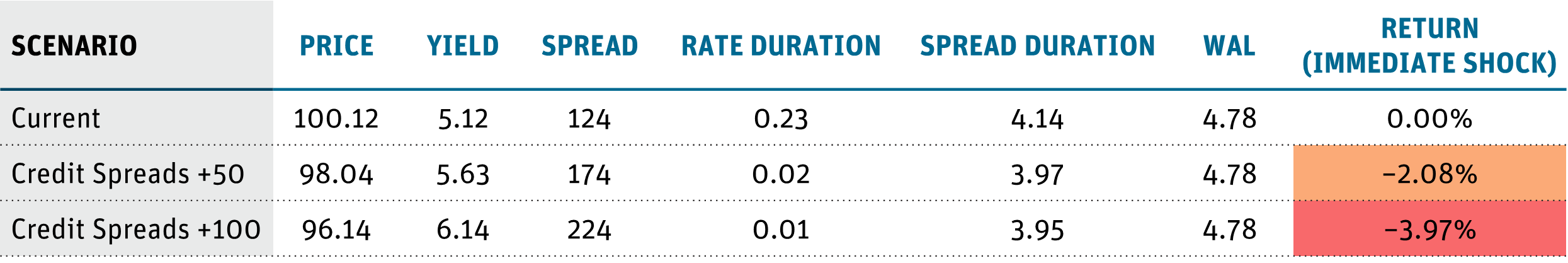

CLOs are predominantly floating rate, while other parts of the securitized credit market are typically fixed rate. As a result, floating-rate securities will not appreciate as much if short-term rates decline and widening spreads can cause price deterioration due to spread duration effects (Figure 3).

Figure 3: Scenario Analysis of Diversified Portfolio of AAA-Rated CLOs

Source: Angel Oak internal analysis from publicly available data as of 10/21/25.

We believe investors should consider diversifying away from concentrated exposure to floating-rate AAA-rated CLOs and into investment-grade fixedrate securitized assets with substantial credit enhancement that would benefit from a declining rate environment.

DEFINITIONS AND DISCLOSURES

Basis Point (bps): One hundredth of one percent and is used to denote the percentage change in a financial instrument.

Bloomberg U.S. Corporate Investment Grade Index: An index that measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD-denominated securities publicly issued by U.S. and non-U.S. industrial, utility and financial issuers.

Collateralized Loan Obligation (CLO): A single security backed by a pool of debt.

Current Coupon: Refers to a security that is trading closest to its par value without going over par. In other words, the bond’s market price is at or near to its issued face value.

Duration: Measures a portfolio’s sensitivity to changes in interest rates. Generally, the longer the duration, the greater the price change relative to interest rate movements.

Floating Rate: A floating-rate security is an investment with interest payments that float or adjust periodically based upon a predetermined benchmark.

Federal Open Market Committee (FOMC): The branch of the Federal Reserve (Fed) that determines the direction of monetary policy in the United States

Spread: The difference in yield between a U.S. Treasury bond and a debt security with the same maturity but of lesser quality.

Weighted Average Life (WAL): Average length of time that each dollar of unpaid principal on a loan, a mortgage or an amortizing bond remains outstanding

Yield Curve: The U.S. Treasury yield curve refers to a line chart that depicts the yields of short-term Treasury bills compared to the yields of long-term Treasury notes and bonds.

Opinions expressed are as of 9/30/25 and are subject to change at any time, are not guaranteed, and should not be considered investment advice.

Investing involves risk; principal loss is possible. Investments in debt securities typically decrease when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower-rated and nonrated securities present a greater risk of loss to principal and interest than do higher-rated securities. Investments in asset-backed and mortgage-backed securities include additional risks that investors should be aware of, including credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Derivatives involve risks different from — and in certain cases, greater than — the risks presented by more traditional investments. Derivatives may involve certain costs and risks such as illiquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lead to losses that are greater than the amount invested. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. The Fund may use leverage, which may exaggerate the effect of any increase or decrease in the value of securities in the Fund’s portfolio or the Fund’s net asset value, and therefore may increase the volatility of the Fund. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are increased for emerging markets. Investments in fixed-income instruments typically decrease in value when interest rates rise. The Fund will incur higher and duplicative costs when it invests in mutual funds, ETFs, and other investment companies. There is also the risk that the Fund may suffer losses due to the investment practices of the underlying funds. For more information on these risks and other risks of the Fund, please see the Prospectus.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Angel Oak Funds. This and other important information about each Fund is contained in the Prospectus or Summary Prospectus for each Fund, which can be obtained by calling 855-751-4324 or by visiting www.angeloakcapital.com. The Prospectus or Summary Prospectus should be read carefully before investing.

Index performance is not indicative of Fund performance. Past performance does not guarantee future results. Current performance can be obtained by calling 855-751- 4324.

The Angel Oak Funds are distributed by Quasar Distributors, LLC.

© 2025 Angel Oak Capital Advisors, which is the adviser to the Angel Oak Funds.