AAA-rated collateralized loan obligations (CLOs) have performed exceptionally well for short-term bond allocators. Rising front-end rates, coupled with a soft-landing economic expectation, provide the ideal environment for these floating-rate bonds. However, falling front-end yields from a cutting Federal Open Market Committee alongside a slower economy could be quite the opposite capital market reality for AAA-rated CLOs. The fixed-income winners of the past 24 months – that is, during the Federal Reserve’s tightening campaign – may not be the winners of the next 24 months. We believe investors should look to lockin higher yields and diversify their short-duration allocations.

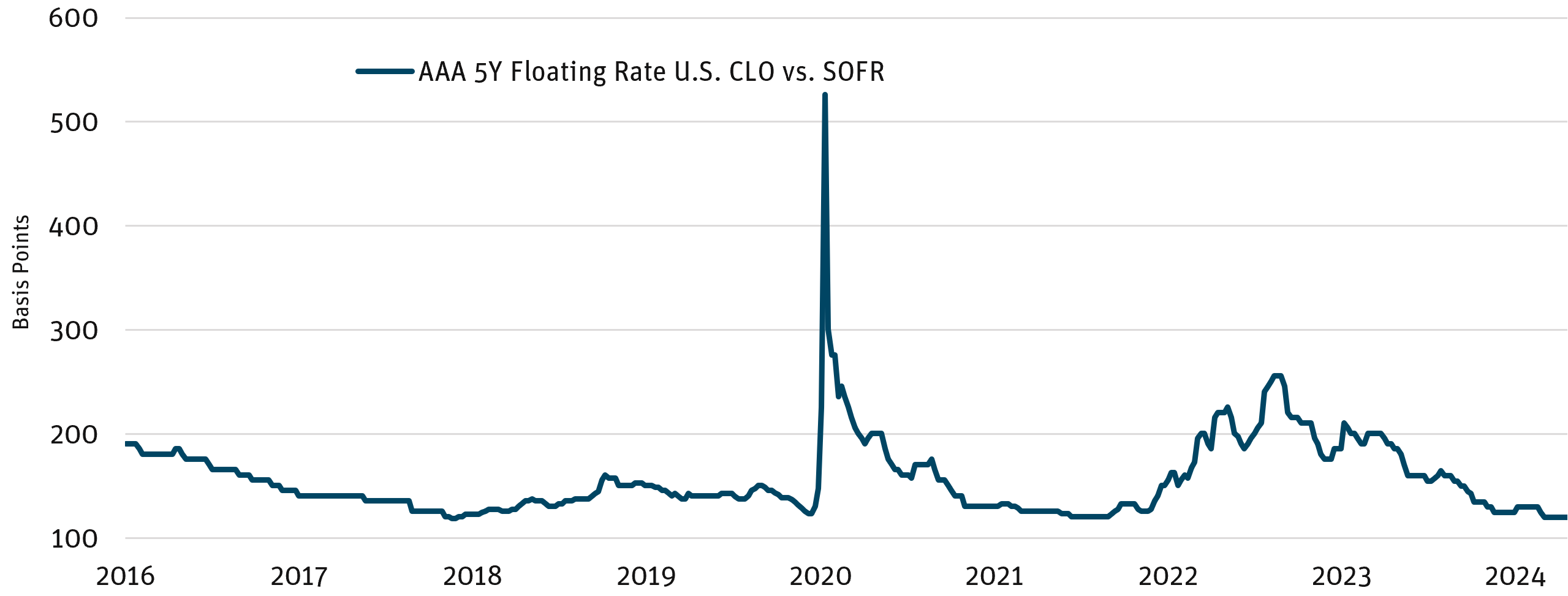

Furthermore, AAA-rated CLO spreads are near all-time tights (Figure 1), limiting further potential spread compression. This compression has been driven by significant demand from allocators of all types – including ETFs, where these securities are now broadly available for the first time.1 Concentrated AAA-rated CLO investors should consider diversifying into other segments of the securitized credit market that are not trading at historical tights.

Figure 1: AAA-Rated 5-Year Floating Rate U.S. CLO vs. SOFR

Source: Bloomberg, Wells Fargo, Bank of America as of 6/30/24.

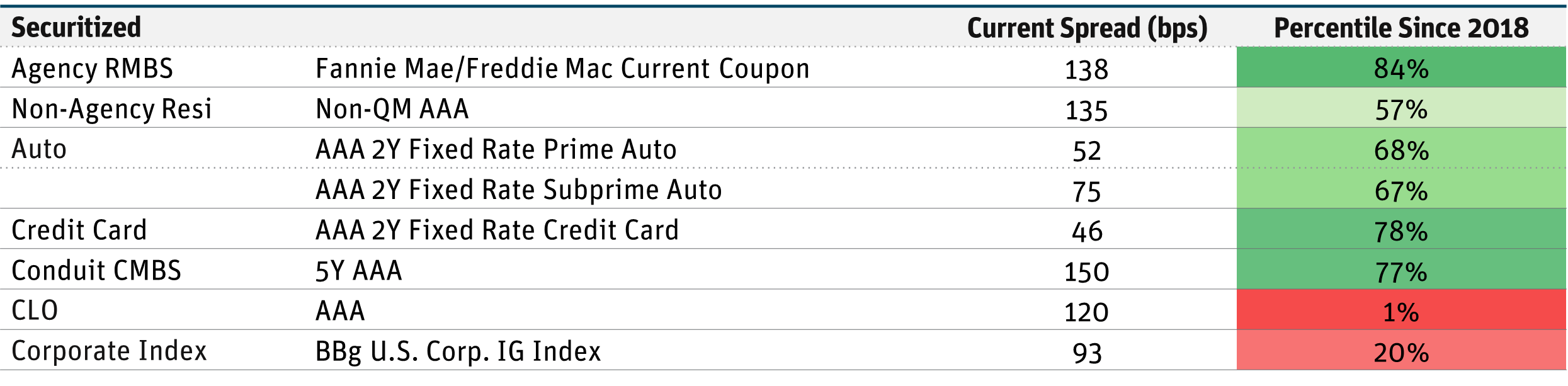

Figure 2 shows the current spreads and the wideness of those spreads for several types of fixed-income asset classes relative to history. Note that spreads of high-quality securities related to corporate credit – CLOs and corporate bonds – are trading near all-time tights. High-quality securitized credit backed by other asset types, including those backed by agency mortgage-backed securities (MBS), non-agency MBS, auto loans, credit cards, and commercial mortgage-backed securities (CMBS), are trading wide compared to historical levels.

Figure 2: Historical Spreads

Source: Bloomberg, Wells Fargo, Bank of America as of 6/30/24.

AAA-rated CLOs currently tend to offer a yield premium relative to other high-quality bonds within the credit market. This is driven by two key factors:

- A longer maturity profile of three to six years with capped upside from callability.

- The current inverted curve favoring one-month floating coupons.

The longer maturity profile of AAA-rated CLOs may surprise some investors in the coming six to 18 months. While their coupons are floating rate, which limits the price volatility if rates were to increase, sensitivity to spread widening has been muted because spreads have been stable and tightening. If rates begin to decline amid a rapidly deteriorating economy, spread volatility may create larger-than-expected price changes for shortduration investors, simultaneous to falling coupon income.

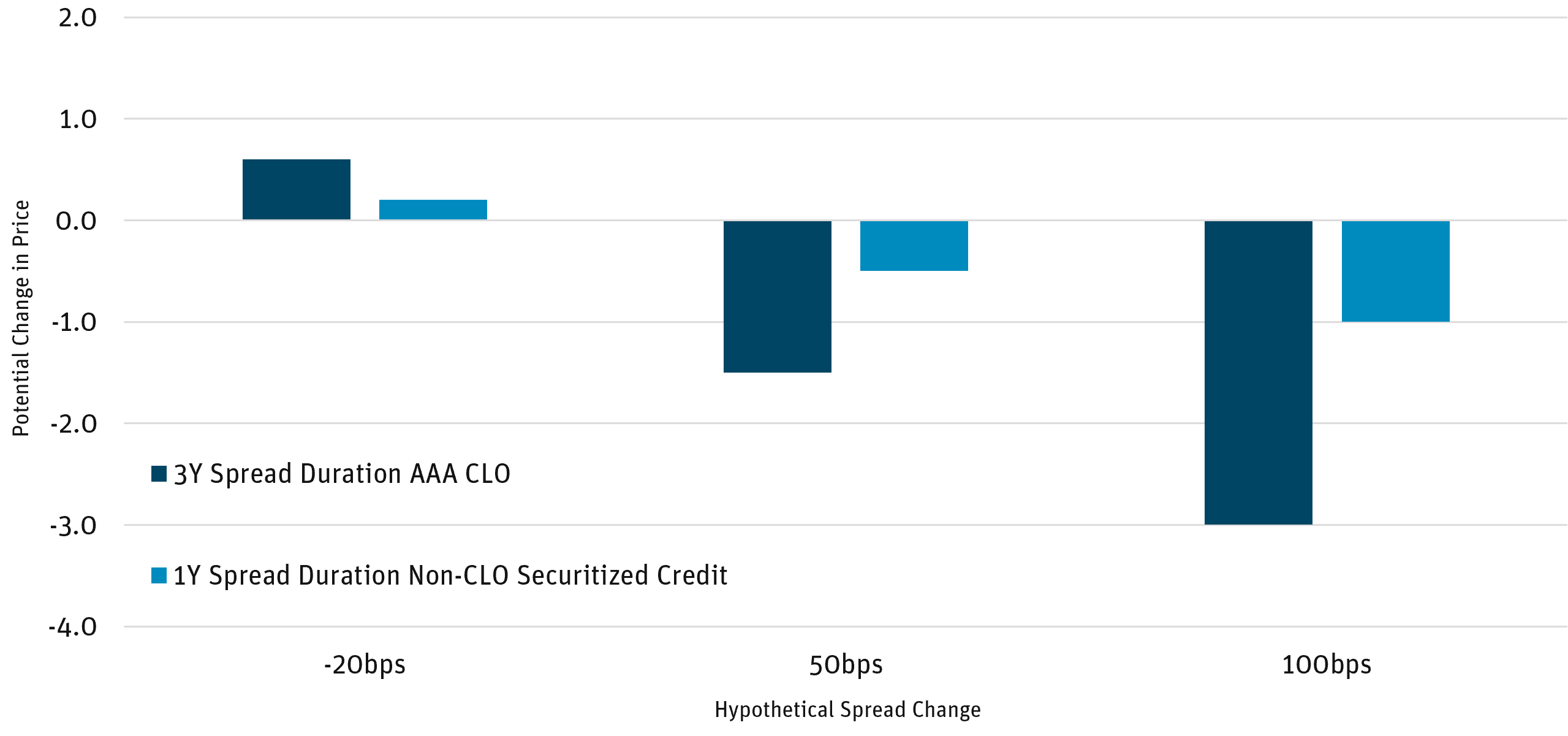

This longer maturity profile is particularly notable relative to other AAA-rated securitized credit bonds, like AAA-rated auto or credit cards, which have spread durations closer to one year. CLO investors demand a spread premium for taking on additional risk in the event of spread widening while their price upside is capped due to callability. Figure 3 shows examples of the price performance for different changes in spread for a hypothetical AAA-rated CLO and a high-quality securitized credit bond, with durations of three years and one year, respectively. Note the greater downside in AAA-rated CLOs.

Figure 3:

Source: Bloomberg, Wells Fargo, Bank of America as of 6/30/24.

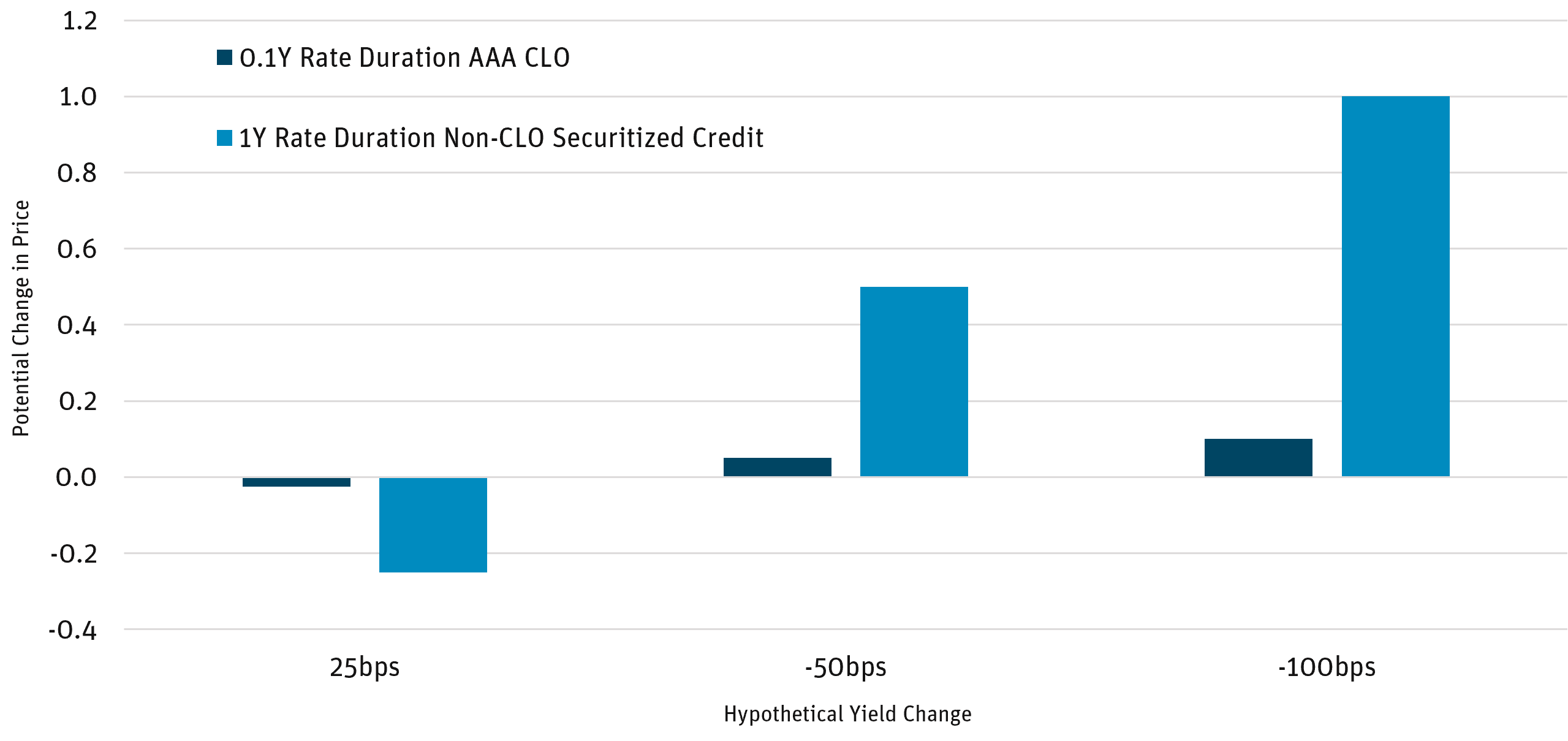

As for the second factor, AAA-rated CLOs tend to be floating rate whereas other elements of the securitized credit market tend to be fixed rate. When the yield curve is inverted, floating-rate securities will offer higher yields than fixed-rate securities. Floating-rate securities will also not appreciate as much if Treasury yields decline (Figure 4).

Figure 4:

Source: Bloomberg, Wells Fargo, Bank of America as of 6/30/24.

AAA-rated CLO spreads are at or near all-time tights. In addition, their significant spread durations and lack of interest-rate exposure offer risks if CLO spreads widen toward historical levels and if rates decline. Therefore, we believe investors should consider diversifying away from just AAArated CLOs into other elements of the securitized credit market.

DEFINITIONS AND DISCLOSURES

Agency Mortgage-Backed Securities (AMBS): Securities issued or guaranteed by the U.S. government or a GSE.

Basis Point (bps): One hundredth of one percent and is used to denote the percentage change in a financial instrument.

Bloomberg U.S. Corporate Investment Grade Index: An index that measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD-denominated securities publicly issued by U.S. and non-U.S. industrial, utility and financial issuers.

Collateralized Loan Obligation (CLO): A single security backed by a pool of debt.

Current Coupon: Refers to a security that is trading closest to its par value without going over par. In other words, the bond’s market price is at or near to its issued face value.

Duration: Measures a portfolio’s sensitivity to changes in interest rates. Generally, the longer the duration, the greater the price change relative to interest rate movements.

Floating Rate: A floating-rate security is an investment with interest payments that float or adjust periodically based upon a predetermined benchmark.

Secured Overnight Financing Rate (SOFR): A broad measure of the cost of borrowing cash overnight collateralized by U.S. Treasury securities.

Spread: The difference in yield between a U.S. Treasury bond and a debt security with the same maturity but of lesser quality.

Yield Curve: The U.S. Treasury yield curve refers to a line chart that depicts the yields of short-term Treasury bills compared to the yields of long-term Treasury notes and bonds.

Opinions expressed are as of 6/30/24 and are subject to change at any time, are not guaranteed, and should not be considered investment advice.

Investing involves risk; principal loss is possible. Investments in debt securities typically decrease when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower-rated and nonrated securities present a greater risk of loss to principal and interest than do higher-rated securities. Investments in asset-backed and mortgage-backed securities include additional risks that investors should be aware of, including credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Derivatives involve risks different from — and in certain cases, greater than — the risks presented by more traditional investments. Derivatives may involve certain costs and risks such as illiquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lead to losses that are greater than the amount invested. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. The Fund may use leverage, which may exaggerate the effect of any increase or decrease in the value of securities in the Fund’s portfolio or the Fund’s net asset value, and therefore may increase the volatility of the Fund. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are increased for emerging markets. Investments in fixed-income instruments typically decrease in value when interest rates rise. The Fund will incur higher and duplicative costs when it invests in mutual funds, ETFs and other investment companies. There is also the risk that the Fund may suffer losses due to the investment practices of the underlying funds. For more information on these risks and other risks of the Fund, please see the Prospectus.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Angel Oak Funds. This and other important information about each Fund is contained in the Prospectus or Summary Prospectus for each Fund, which can be obtained by calling 855-751-4324 or by visiting www.angeloakcapstg.wpengine.com. The Prospectus or Summary Prospectus should be read carefully before investing.

Index performance is not indicative of Fund performance. Past performance does not guarantee future results. Current performance can be obtained by calling 855-751-4324.

The Angel Oak Funds are distributed by Quasar Distributors, LLC.

© 2024 Angel Oak Capital Advisors, which is the adviser to the Angel Oak Funds.