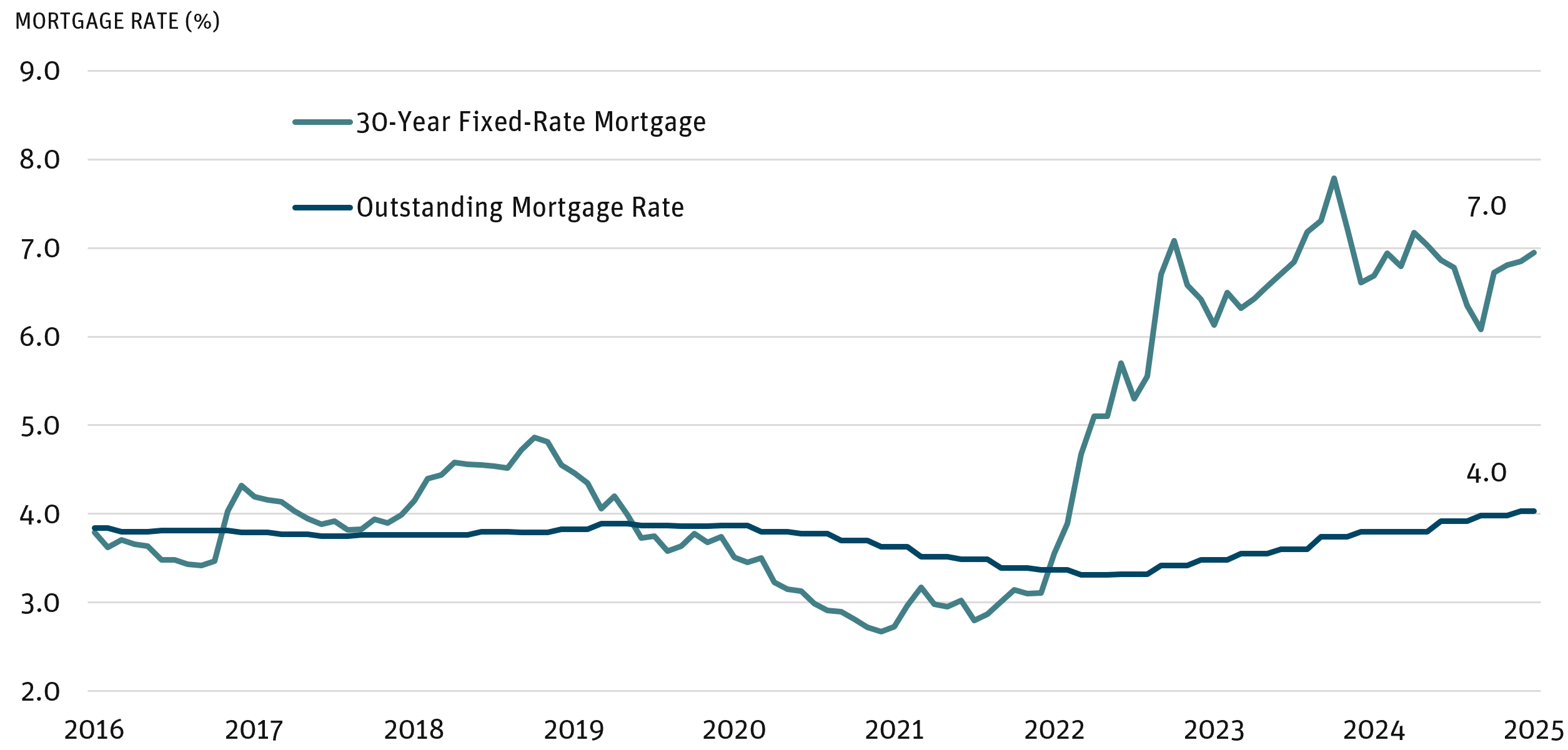

When the Fed lowered rates at the September 2024 FOMC meeting, potential buyers in the housing market were hoping they would finally see lower financing costs. While mortgage rates initially moved lower after the Fed rate decision, they were back up above 7.0% by January 2025. Although we are aligned with the market’s view that the Fed will likely continue to lower rates at some point in 2025, it looks unlikely in the near term as heightened concerns around recent elevated levels of inflation appear to have put the Fed on hold. While this has impacted housing affordability, housing fundamentals continue to be supported by shortages in inventory, anemic housing starts, relatively high current mortgage rates that reduce refinancing/resale incentives for homeowners, and tight credit standards.

Current vs. Effective Mortgage Rates

Source: Bloomberg as of 1/31/25.

Housing affordability continues to be impacted by higher prevailing mortgage rates relative to average rates on all outstanding mortgages. Borrowers that locked in low rates during the COVID era show few signs of escaping the “golden handcuffs” that have muted housing inventory turnover.

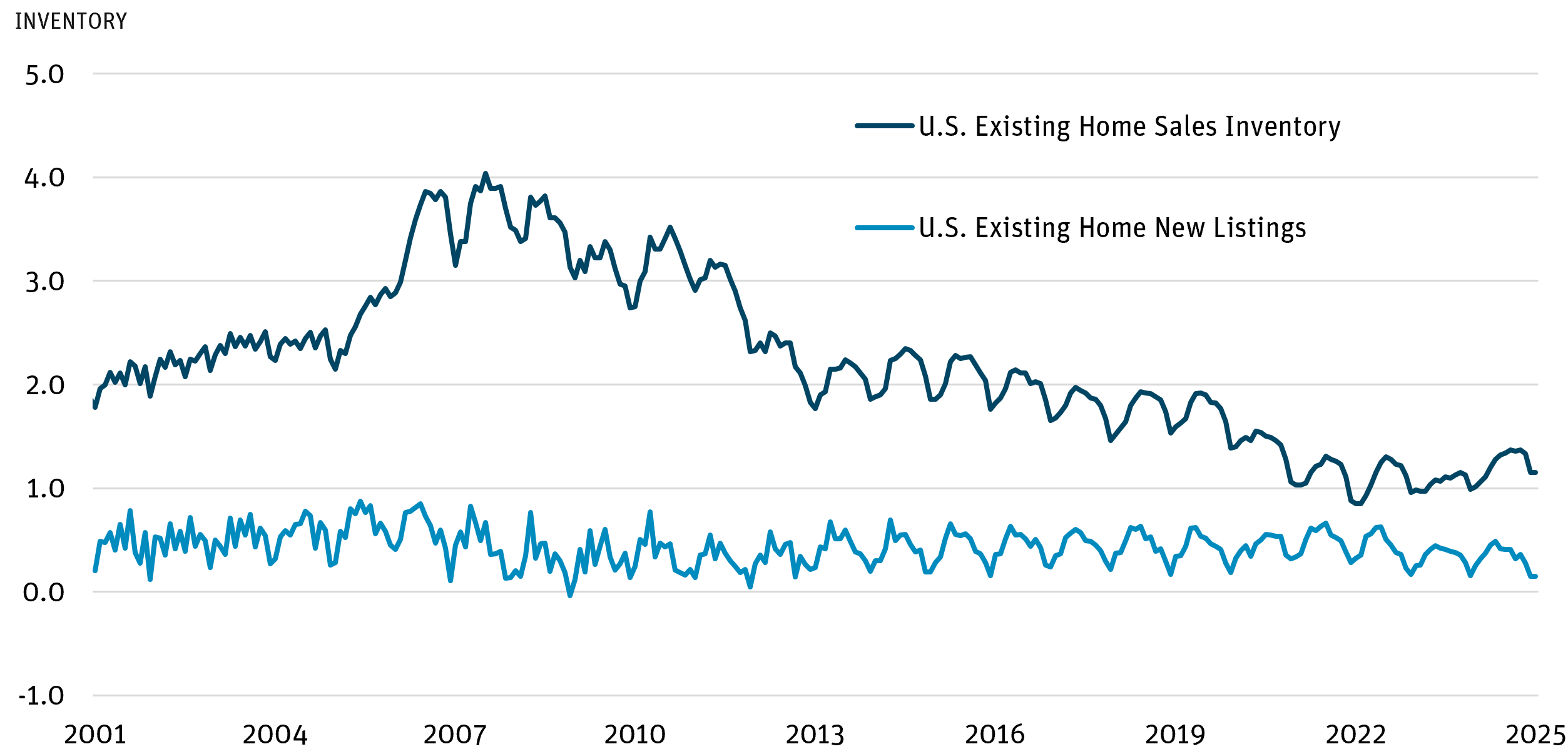

Single-Family Inventory Indices

Source: Bloomberg as of 1/31/25.

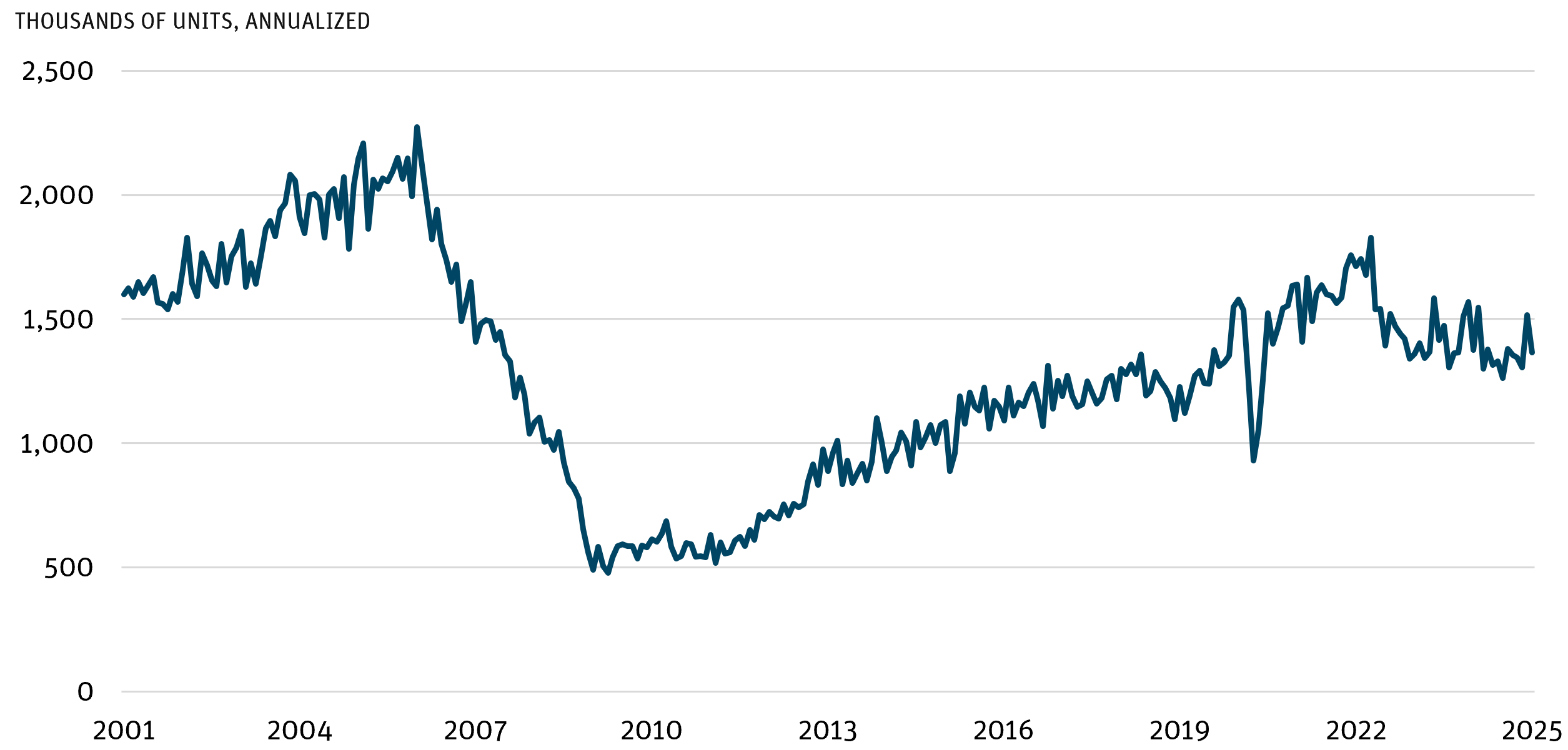

HPA slowed but was still positive in 2024, although shortages of inventory will continue to be the main driver supporting home values after a decade of underbuilding post-global financial crisis (GFC). New housing starts could mitigate this deficiency but continue to lag levels seen before 2006.

U.S. New Housing Starts

Source: FRED as of 1/31/25.

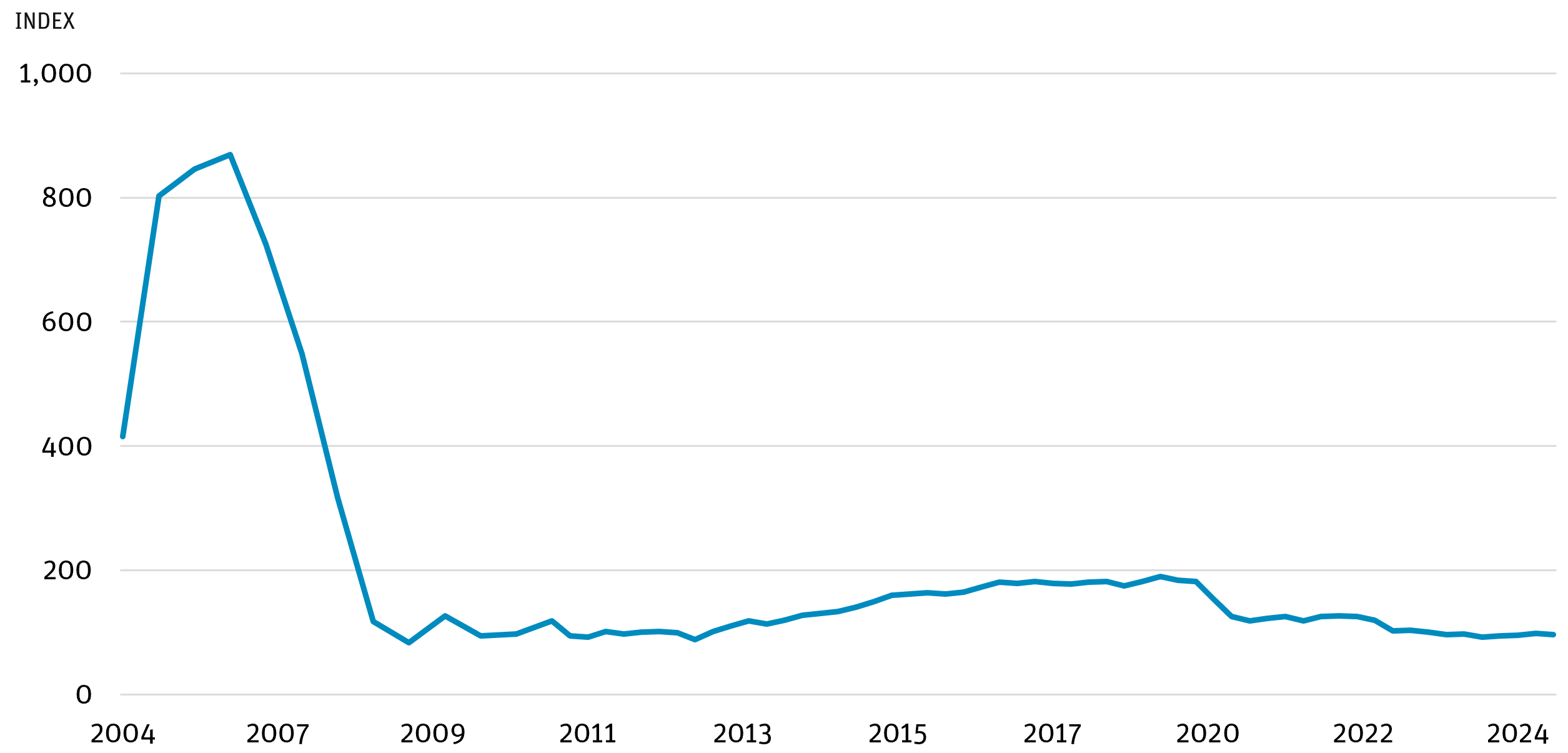

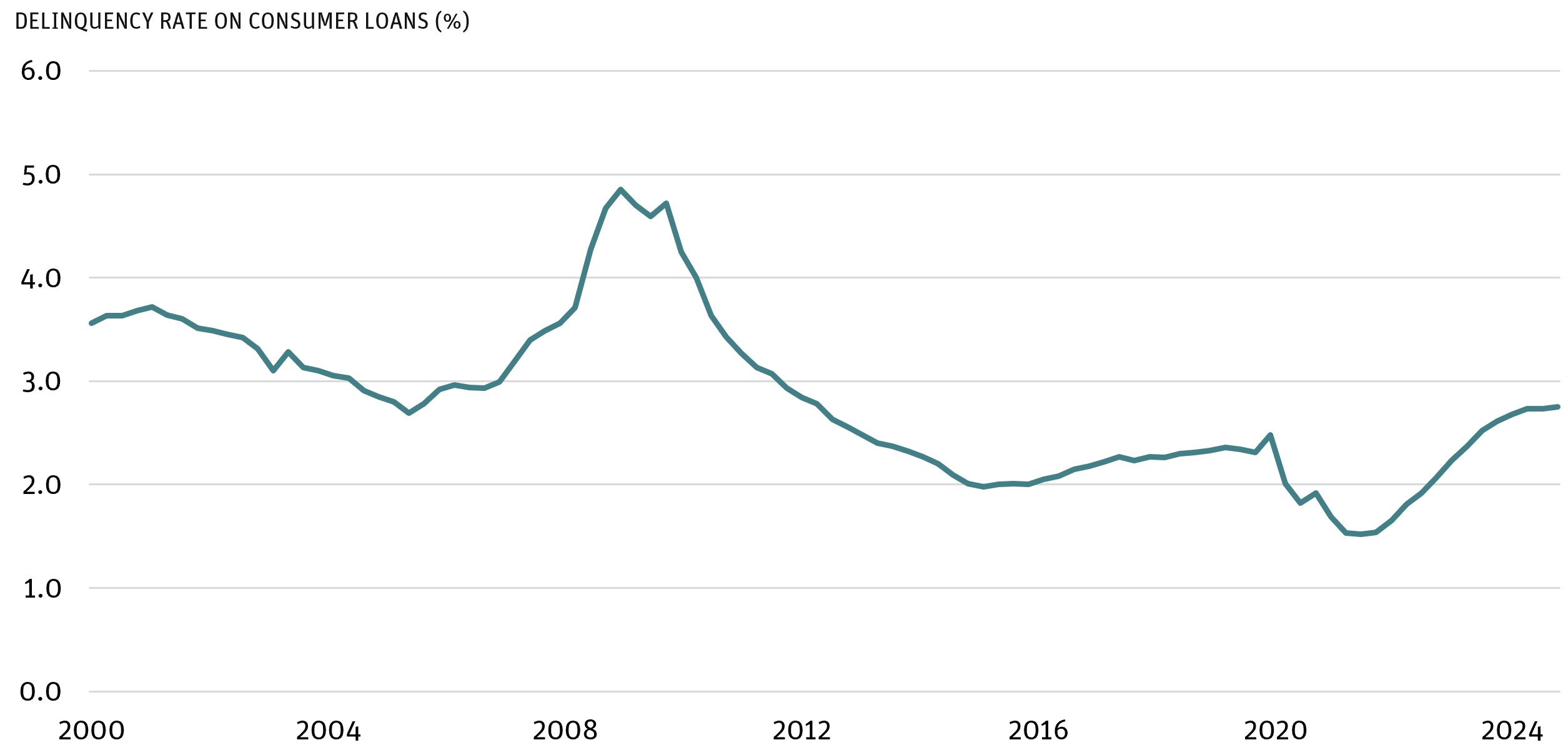

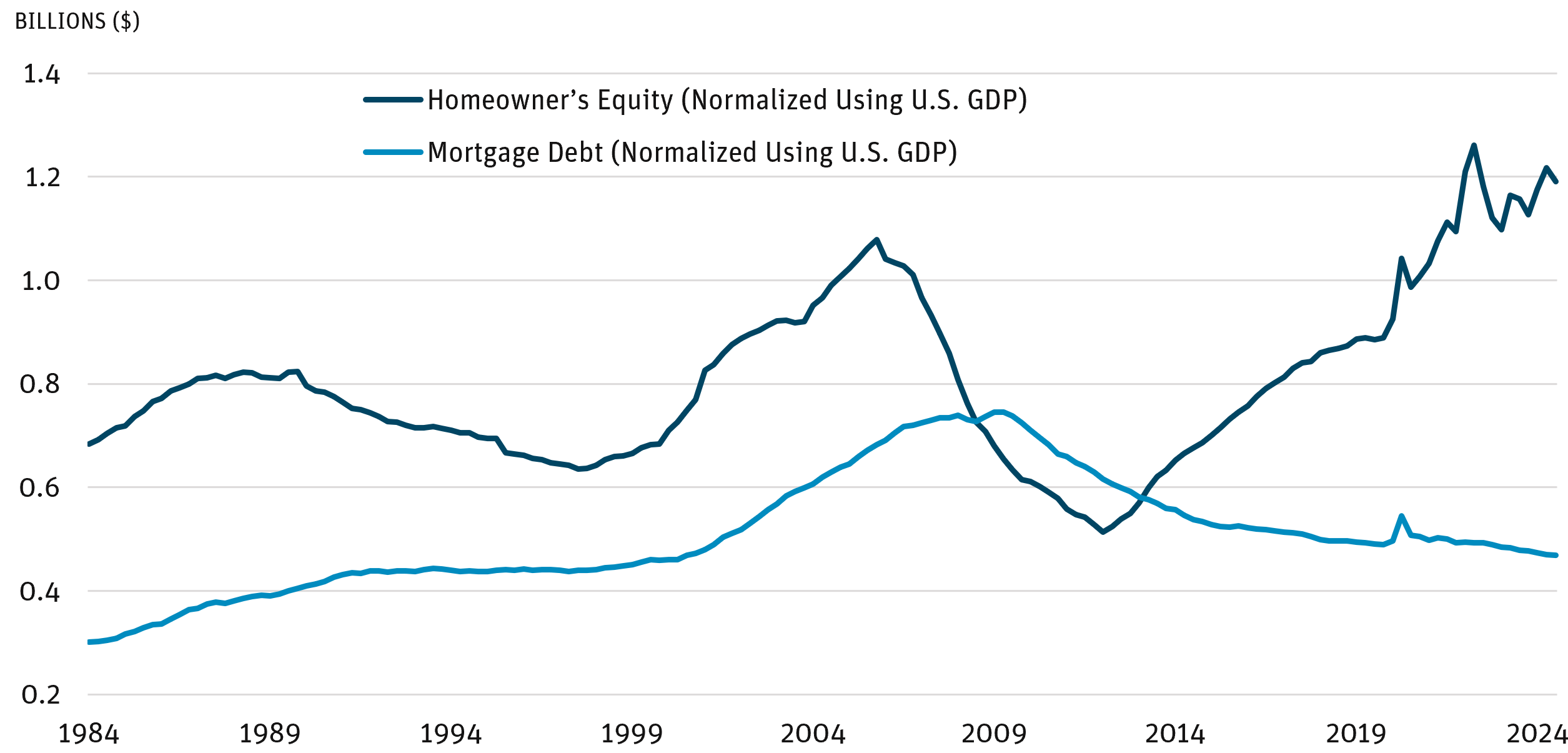

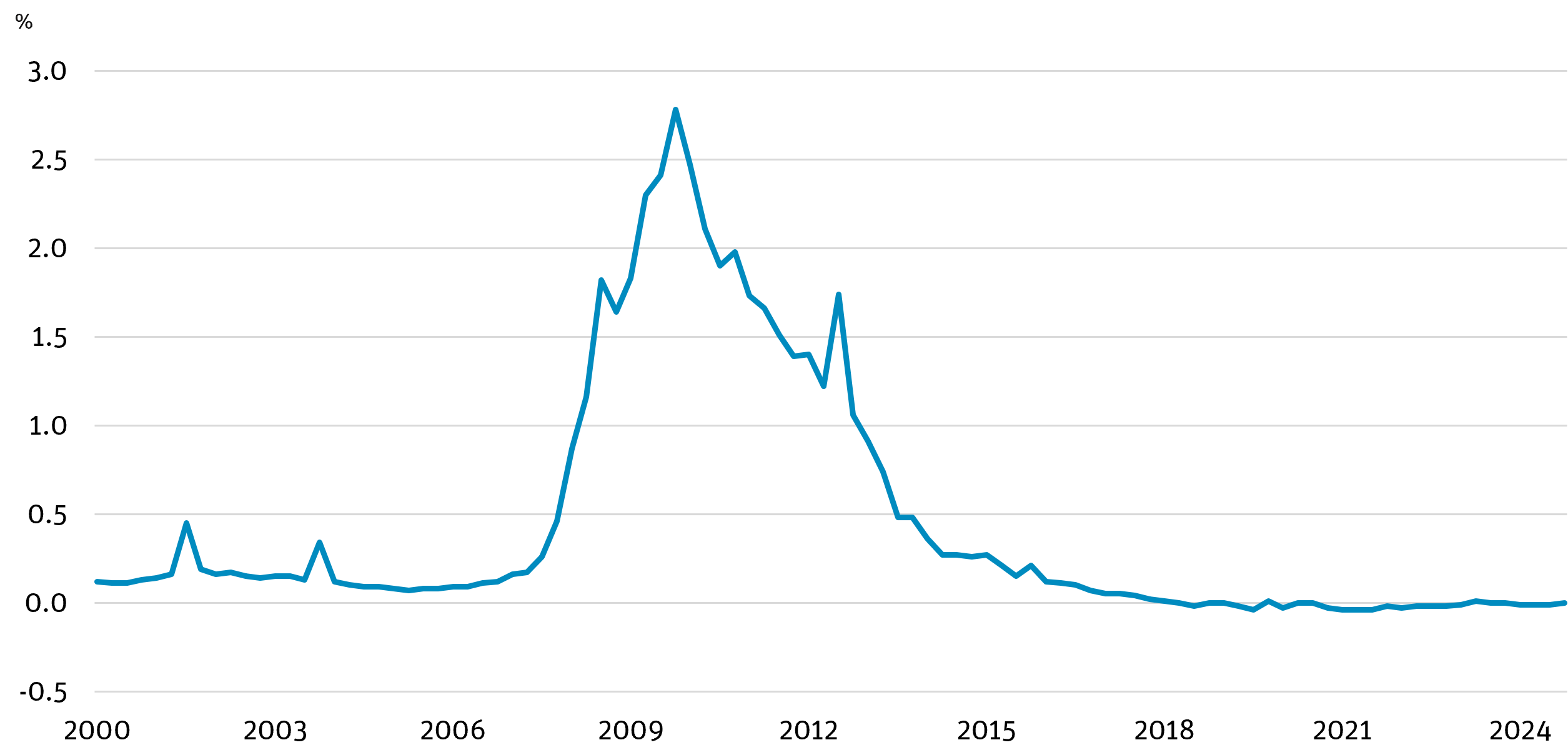

Mortgage credit continues to remain tight, unlike the period prior to 2008 when the loosening of credit was a significant contributor to the housing crash during the GFC. Stronger post-crisis underwriting standards have combined with historically high levels of home equity to drive a very positive credit environment, as an uptick in delinquencies across various sectors of consumer credit has not resulted in significantly higher default losses on mortgages reflected in charge-off rates at commercial banks. In fact, high levels of home equity have driven low loan-to-value ratios, generating net recoveries on defaulted mortgages during much of the post-COVID period.

Mortgage Credit Availability Index

Source: Bloomberg as of 12/31/24.

Consumer Loan Delinquency Rates

Source: FRED as of 12/31/24.

U.S. Housing Equity at Historic Highs While Household Debt Declines

Source: FRED as of 12/31/24.

Charge-Off Rates on Residential Mortgages

Source: FRED as of 12/31/24.

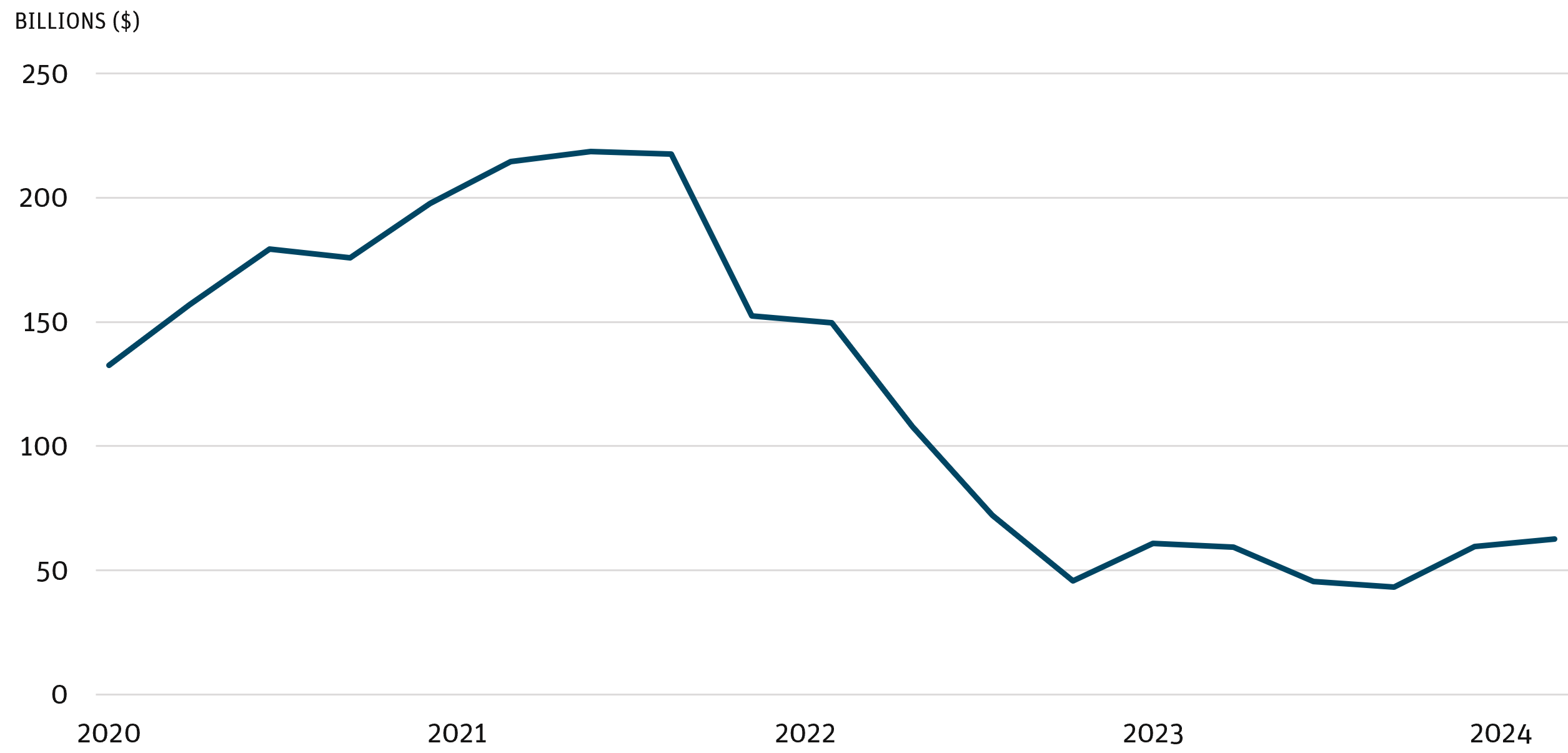

While housing affordability and activity will continue to be pressured in the near term, housing fundamentals remain strong. Also, we think there could be some relief in mortgage rates that will drive mortgage originations back to more normal levels, but it will not come from the Fed. Over the past few years banks have largely been absent from the residential mortgage-backed securities (RMBS) market. We believe that a steepening yield curve, deposit stabilization, and softer regulatory requirements should bring banks back into the market. This increased demand for RMBS from banks should tighten spreads and create total return opportunities in this sector in 2025 and beyond.

Bank Mortgage Originations

Source: FRED as of 12/31/24.

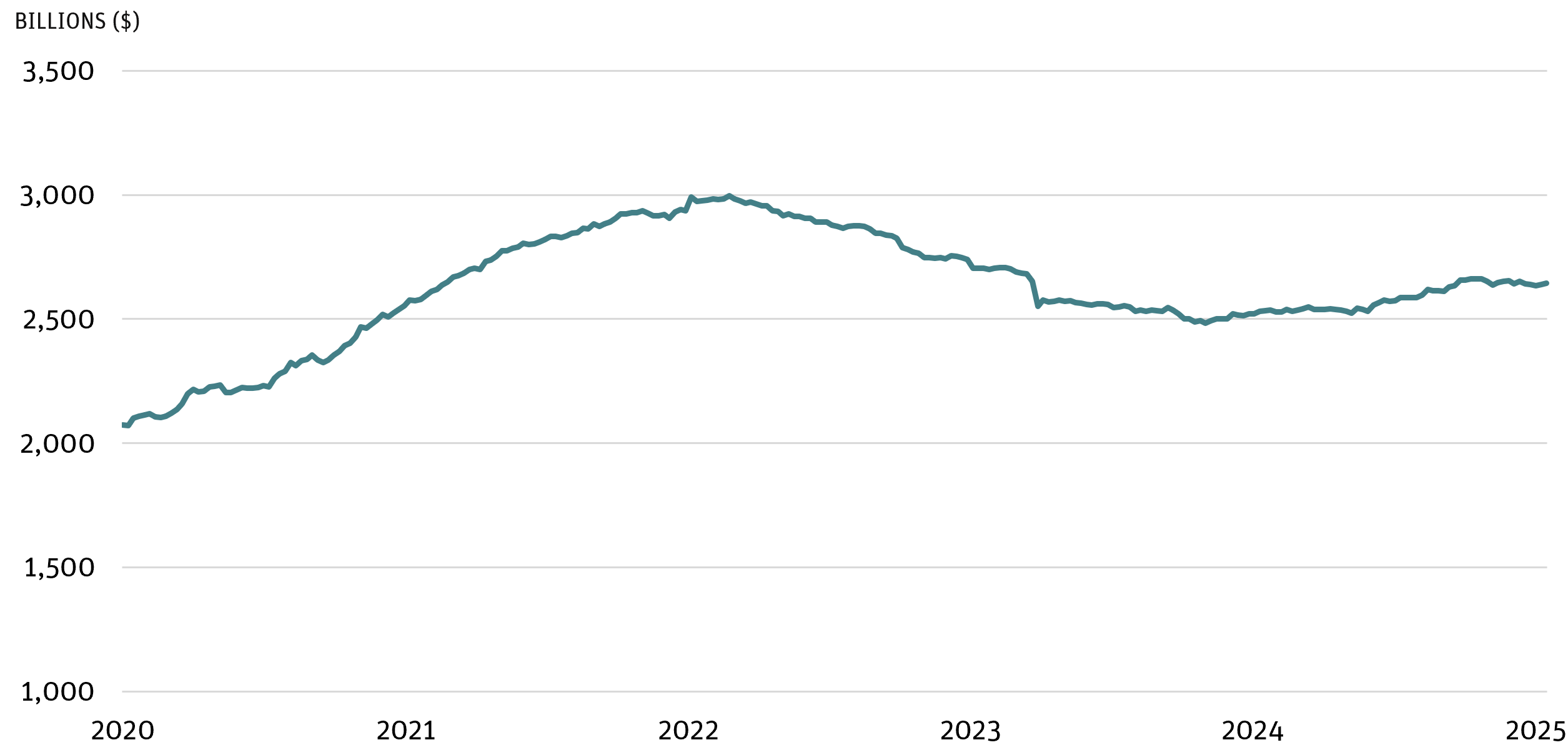

Bank RMBS Holdings

Source: FRED as of 1/31/25.

Definitions And Disclosures

Agency Mortgage-Backed Securities (AMBS): Securities issued or guaranteed by the U.S. government or a GSE.

Basis Point (bps): One hundredth of one percent and is used to denote the percentage change in a financial instrument.

Delinquencies: Represent a neglect in making required payments on a debt.

Mortgage-Backed Security (MBS): A type of asset-backed security which is secured by a mortgage or collection of mortgages.

Mortgage Credit Availability Index (MCAI): The MCAI is a barometer of the availability of mortgage credit using guidelines from institutional investors who purchase loans through the broker and/or correspondent channels.

Opinions expressed are as of 1/31/25 and are subject to change at any time, are not guaranteed, and should not be considered investment advice.

Investing involves risk; principal loss is possible. Investments in debt securities typically decrease when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower-rated and nonrated securities present a greater risk of loss to principal and interest than do higher-rated securities. Investments in asset-backed and mortgage-backed securities include additional risks that investors should be aware of, including credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Derivatives involve risks different from — and in certain cases, greater than — the risks presented by more traditional investments. Derivatives may involve certain costs and risks such as illiquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lead to losses that are greater than the amount invested. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. The Fund may use leverage, which may exaggerate the effect of any increase or decrease in the value of securities in the Fund’s portfolio or the Fund’s net asset value, and therefore may increase the volatility of the Fund. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are increased for emerging markets. Investments in fixed-income instruments typically decrease in value when interest rates rise. The Fund will incur higher and duplicative costs when it invests in mutual funds, ETFs and other investment companies. There is also the risk that the Fund may suffer losses due to the investment practices of the underlying funds. For more information on these risks and other risks of the Fund, please see the Prospectus.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Angel Oak Funds. This and other important information about each Fund is contained in the Prospectus or Summary Prospectus for each Fund, which can be obtained by calling 855-751-4324 or by visiting www.angeloakcapital.com. The Prospectus or Summary Prospectus should be read carefully before investing.

Index performance is not indicative of Fund performance. Past performance does not guarantee future results. Current performance can be obtained by calling 855-751- 4324.

The Angel Oak Funds are distributed by Quasar Distributors, LLC.

© 2025 Angel Oak Capital Advisors, which is the adviser to the Angel Oak Funds.