We have long been calling for the return of a robust M&A environment, driven by a more-accommodating regulatory backdrop, strong sector fundamentals, and improved valuations. The October 6 announcement that Fifth Third Bancorp (FITB) will acquire Comerica (CMA) for $10.9 billion marks the latest—and largest—deal in an accelerating 2025 acquisition trend.

July 2025 recorded the highest number of deal announcements (26) since June 2021. The announced merger of equals between Pinnacle Financial Partners Inc. (PNFP) and Synovus Financial Corp. (SNV) in July marked the largest post-COVID-19 deal, while the FITB/CMA deal now represents the biggest U.S. bank deal since BB&T merged with SunTrust in 2019.

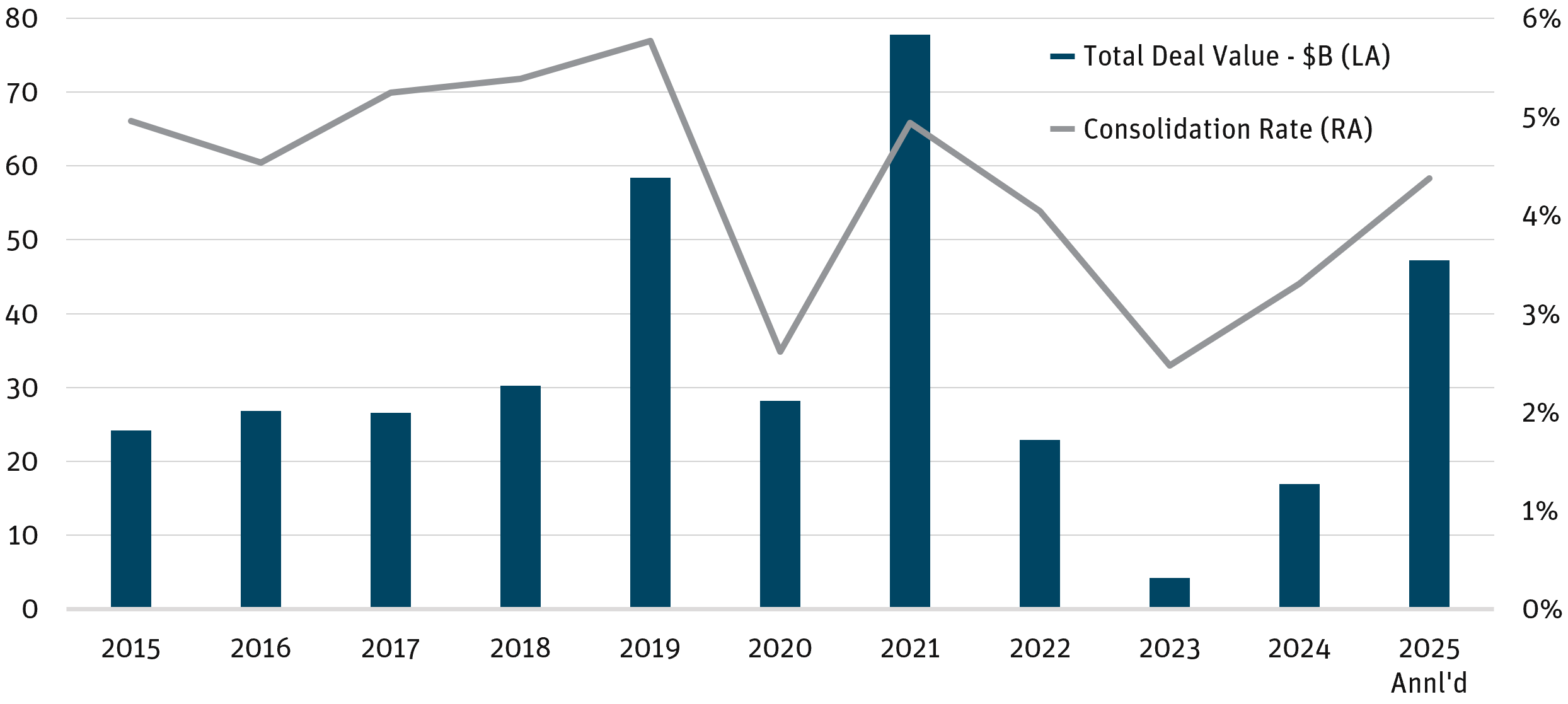

Year-to-date, 133 M&A deals have been announced, equal with the 133 for all of 2024. Total assets, deposits, and deal value have also surpassed 2024 and 2023 combined. Strong sector fundamentals, steady credit quality, improved investor sentiment, and a more favorable rate environment have clearly contributed to this latest wave. Bank management teams additionally cite faster deal closings as a key catalyst for renewed consolidation.

Figure 1: Banking Sector M&A

Source: S&P Capital IQ as of 10/7/25.

Figure 2: Banking Industry M&A

Source: S&P Capital IQ as of 10/7/25.

TRANSACTION HIGHLIGHTS

FITB announced plans to purchase CMA for $10.9 billion, creating a pro forma institution with $288 billion in assets. This powerhouse franchise will become the ninth-largest bank in the U.S., representing the largest merger of U.S. public companies since BB&T acquired SunTrust in 2019. More importantly, the deal signals a regulatory openness to regional bank M&A, a willingness that has largely been absent for larger institutions in the post-financial-crisis era.

STRONG FUNDAMENTALS AND IMPROVED SENTIMENT DRIVE INCREASED APPETITE FOR M&A

Banking sector fundamentals remain solid, with expanding net interest margins, benign credit quality, and stronger-than-anticipated loan growth. Lower short-end rates and a steepening yield curve provide ongoing positive support for these trends.

M&A pricing has also rebounded, reflecting improved investor sentiment regarding both buyers and sellers. The median price to tangible book value (P/TBV) for all M&A deals peaked at 154% in 2022 before plummeting in 2023 due to the regional bank liquidity crisis. (In 2025, the average P/TBV has recovered to 147%.) Sector valuations remain historically cheap compared to both broader equity markets and long- term averages—presenting a potential sweet spot for seasoned buyers to pay appropriate prices to pursue scale and realize significant-yet- achievable cost benefits. For FITB/CMA, the market seems to find the purchase price reasonable at just 175% of TBV, which equates to just 7.9x pro forma earnings when factoring in expected cost savings.

LIGHTER-TOUCH REGULATORY ENVIRONMENT AND FASTER APPROVALS

A softer regulatory approach under the Trump administration has been one of the key drivers of rising M&A activity. Under the Biden administration, the approval process was often lengthy and burdensome, with some deals requiring unrelated concessions. Larger transactions, in particular, struggled to close.

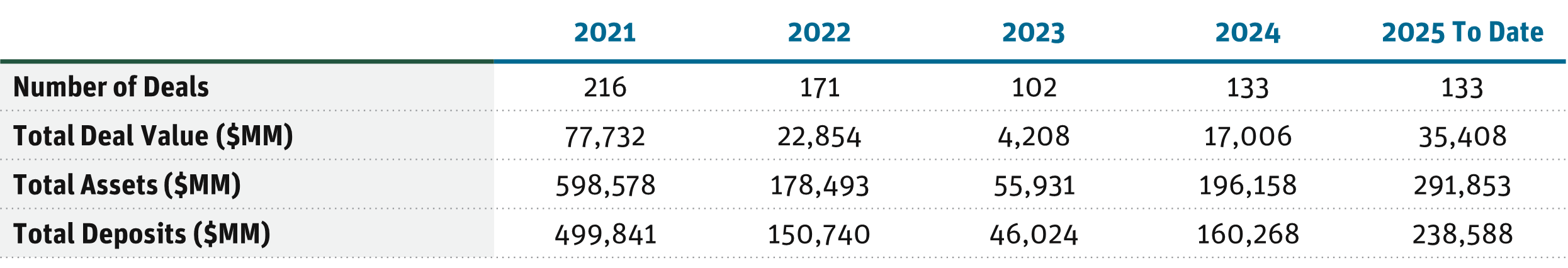

In contrast, the current administration has encouraged consolidation, shortened the approval timeline by roughly half, and signaled potential regulatory capital relief. Recently announced deals have closed in a median of just 110 days, underscoring the more-streamlined process.

Figure 3: Bank M&A Average Time to Close

Note: Includes transactions with target assets greater than $3B. Source: KBW Research, S&P Capital IQ as of 10/6/25.

M&A HISTORICALLY BENEFITS BANK DEBT STRATEGIES

Banking sector consolidation has long been a key tenet of our bank debt strategies and has been a source of alpha generation historically. Given the overbanked nature of the U.S., Angel Oak expects this trend to accelerate, especially among community and regional banks. Beyond expanding growth opportunities into new markets and products, M&A provides a tangible solution for banks to reduce expenses and scale large fixed costs. Banking sector consolidation has the potential to lead to price appreciation for bank debt when a larger, well-capitalized bank acquires a smaller bank and assumes the smaller bank’s debt. This has historically resulted in spread tightening and meaningful price appreciation in the bonds of the smaller bank.

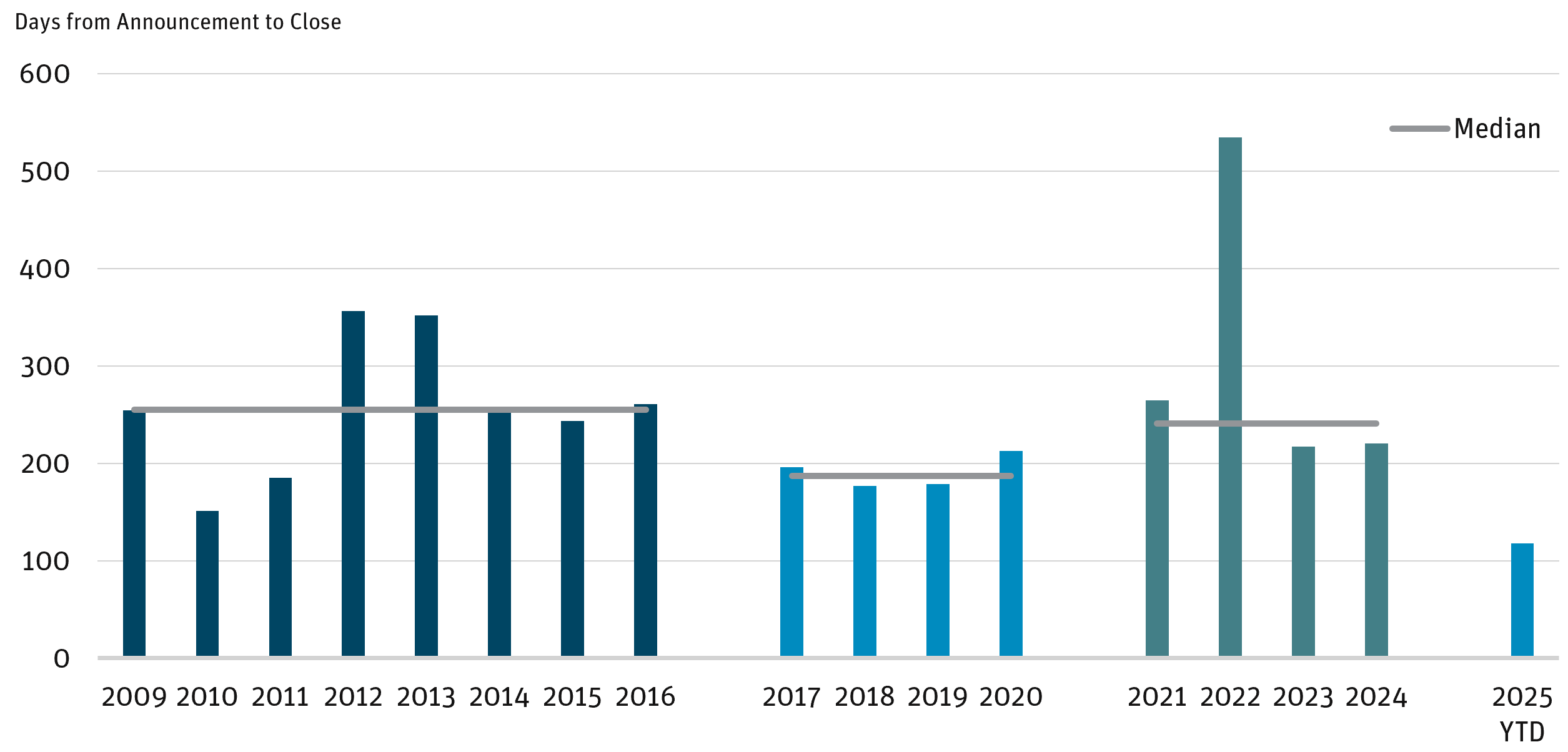

ISSUANCE DYNAMICS ACCRETIVE

In addition to accelerating M&A activity, 2025 has also seen an explosion of bank debt primary market issuance. After a dearth of primary market issuance over the past two years due to rising interest rates and the regional banking crisis in 2023, recent issuance has surged, putting 2025 on pace to be the strongest year since 2022. More than $10 billion of 2020-vintage issuance reaches its call period this year, with another roughly $8.5 billion becoming callable in 2026. Most bank debt is typically refinanced at or around the call date due to declining Tier 2 capital treatment (recall that sub-debt bonds lose regulatory Tier 2 capital eligibility at 20% per year when there is less than five years to maturity). The resurgence in primary market issuance has supported improved pricing for legacy positions and higher coupons on new portfolio additions. Bank debt spreads have normalized to historical levels as issuance momentum continues to strengthen.

Figure 4: Bank Debt Primary Market Issuance

Source: Piper Sandler, KBW, Performance Trust as of 9/30/25.

BULLISH ON BANKS

We entered 2025 perhaps the most bullish we have ever been on the banking sector, and our thesis is playing out. Banks are driving earnings growth through NIM expansion and loan growth, credit conditions remain benign, capital levels are strong, regulatory capital relief is on the horizon, and M&A has come back in vogue. As regulatory and interest rate pressures continue to ease, the sector is poised to continue its forward momentum, enabling management teams to execute long-term strategic initiatives that benefit all stakeholders.

Bank debt issuance has rebounded sharply and remains attractively priced, while bank equities continue to trade at a discount relative to both the broader equity markets and their own historical averages. We believe banks represent an undervalued opportunity in an inefficiently priced sector whose time has come.

DEFINITIONS AND DISCLOSURES

Alpha: Measures the difference between a fund’s actual returns and its expected performance, given its level of risk (as measured by beta). A positive alpha figure indicates the fund has performed better than its beta would predict. In contrast, a negative alpha indicates a fund has underperformed, given the expectations established by the fund’s beta.

M&A: Mergers and acquisitions.

Net Interest Margin (NIM): An industry-specific profitability ratio for banks and other financial institutions. It is a measure of the spread a bank earns between interest income and the amount of interest paid out to its depositors, expressed as a percentage of earning assets.

Price-to-Tangible Book Value: A financial ratio used to compare a company’s current market price to its book value.

Spread: The difference in yield between two bonds of similar maturity but different credit quality.

Tier 2 Capital: A bank’s supplementary capital including evaluation reserve, undisclosed reserves, hybrid security, and subordinate debt.

Must be preceded or accompanied by a prospectus. To obtain an electronic copy of the prospectus, please visit www.angeloakcapital.com.

Opinions expressed are as of 10/6/25 and are subject to change at any time, are not guaranteed, and should not be considered investment advice

Investing involves risk; principal loss is possible. Investments in debt securities typically decrease when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower-rated and nonrated securities present a greater risk of loss to principal and interest than do higher-rated securities. Investments in asset-backed and mortgage-backed securities include additional risks that investors should be aware of, including credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Derivatives involve risks different from — and in certain cases, greater than — the risks presented by more traditional investments. Derivatives may involve certain costs and risks such as illiquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lead to losses that are greater than the amount invested. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. The Fund may use leverage, which may exaggerate the effect of any increase or decrease in the value of securities in the Fund’s portfolio or the Fund’s net asset value, and therefore may increase the volatility of the Fund. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are increased for emerging markets. Investments in fixed-income instruments typically decrease in value when interest rates rise. The Fund will incur higher and duplicative costs when it invests in mutual funds, ETFs and other investment companies. There is also the risk that the Fund may suffer losses due to the investment practices of the underlying funds. For more information on these risks and other risks of the Fund, please see the Prospectus.

Past performance does not guarantee future results. Index performance is not indicative of Fund performance. Current Fund performance can be obtained by calling 855-751-4324.

A full list of fund holdings can be found at www.angeloakcapital.com/resources and are subject to risk and to change at anytime. Any discussion of individual companies is not intended as a recommendation to buy, hold, or sell securities issued by those companies.

The Angel Oak Funds are distributed by Quasar Distributors, LLC.

© 2025 Angel Oak Capital Advisors, which is the adviser to the Angel Oak Funds.