Persistent inflation lingering in the market in the wake of the COVID era has led the Federal Reserve to leave interest rates at elevated levels throughout 2024 after hiking interest rates 11 times since March 2022. While inflation has steadily declined from its 9.1% peak in June 2022 to a recent read of 3.4% in April 2024, it remains stubbornly high. However, the Fed continues to reiterate that they are done hiking rates making fixed income more attractive to own, particularly longer duration assets.

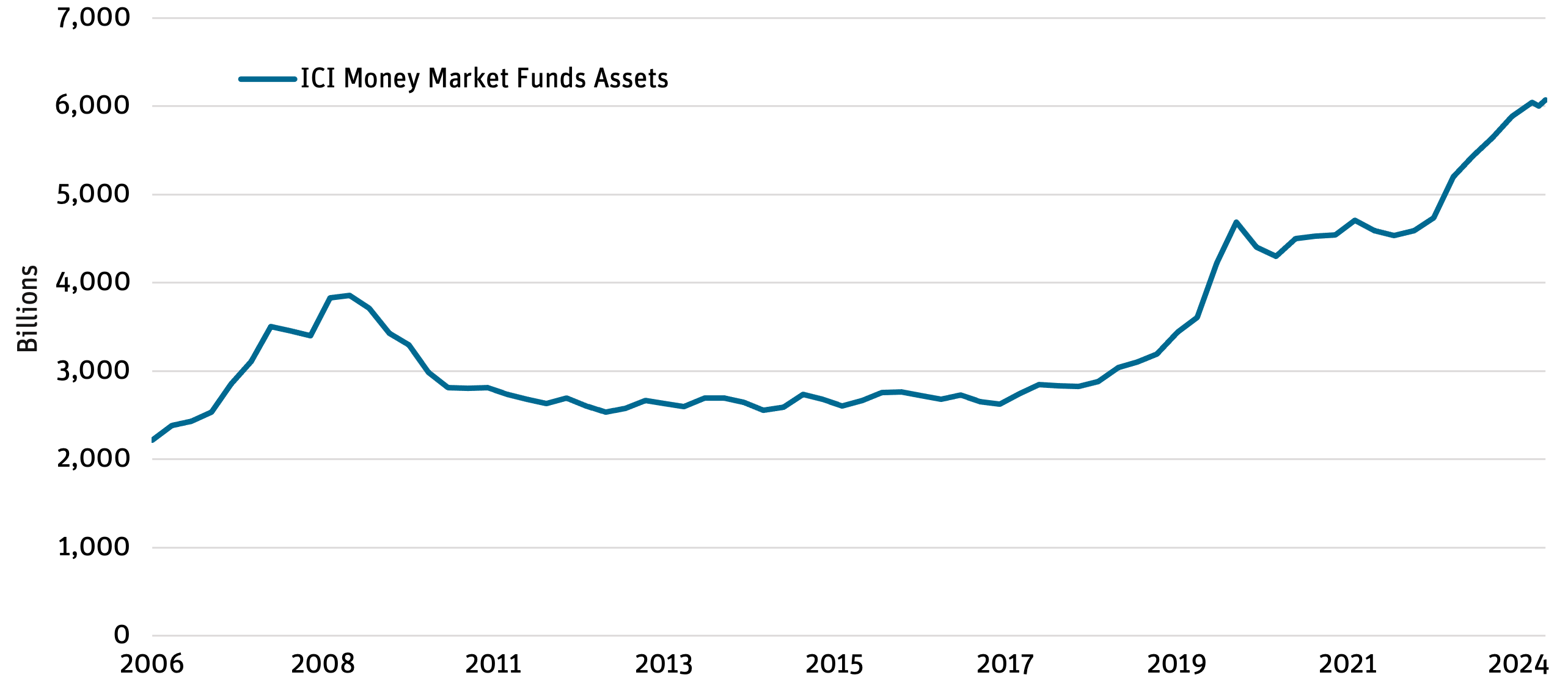

As we head into the second half of 2024, we believe securitized credit—specifically mortgages—is a better place to invest additional fixed-income dollars, due to softening interest rate volatility, increased demand from investors that have a record amount of cash on the sidelines (Figure 1), and better relative value.

We consider this to be an important time for investors to move out the curve and extend duration to capture outsized yields for a longer period of time from existing cash balances that may be impacted by interest rates falling later this year.

Figure 1: Record Amount of Money Market Fund Assets

Source: Bloomberg as of 5/31/24.

Heightened interest rate volatility, along with a buyer’s strike in securitized mortgage credit, led to underperformance versus corporate credit over the past two years. We believe the spread widening relative to corporates has gone too far and created a historically attractive investment opportunity. We believe securitized mortgage credit, where equity-like return opportunities exist in senior secured cash flows, may benefit as allocators return and identify the relative value.

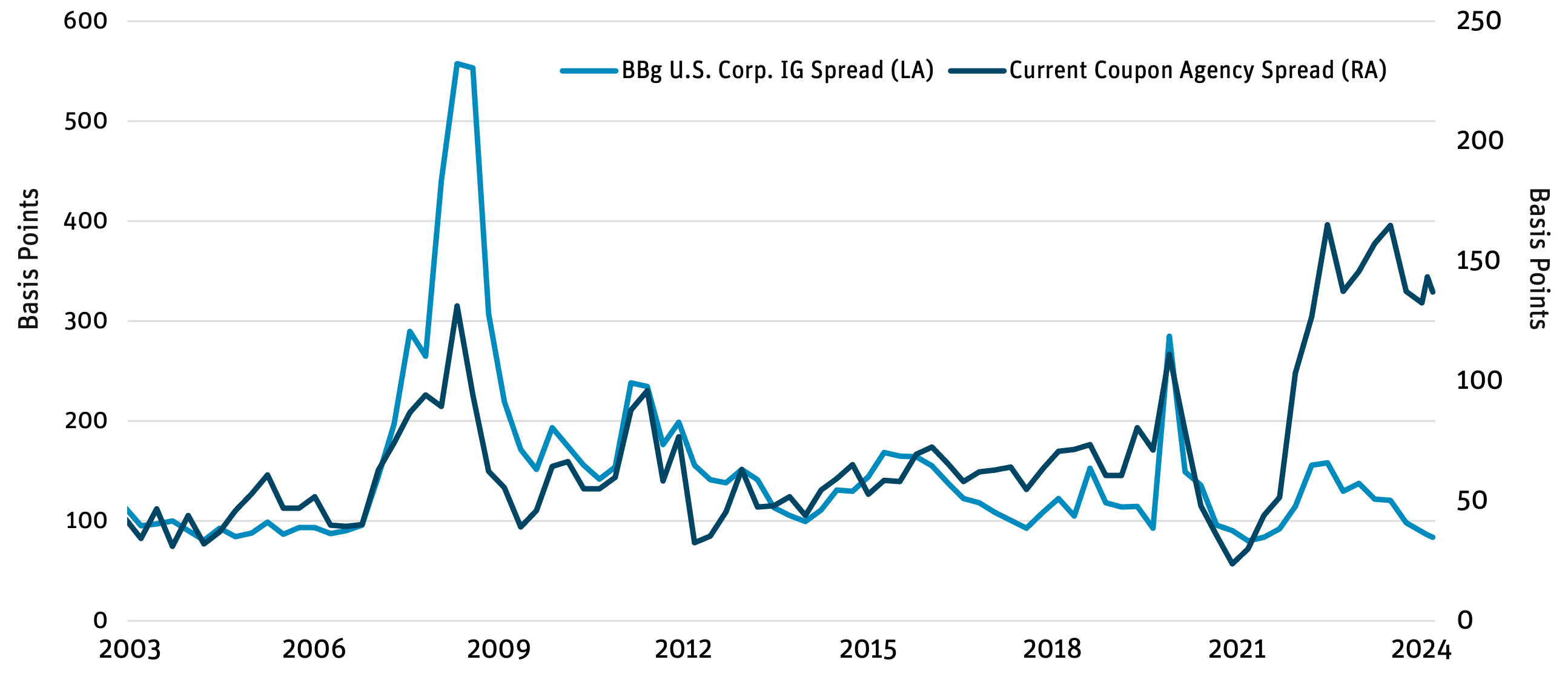

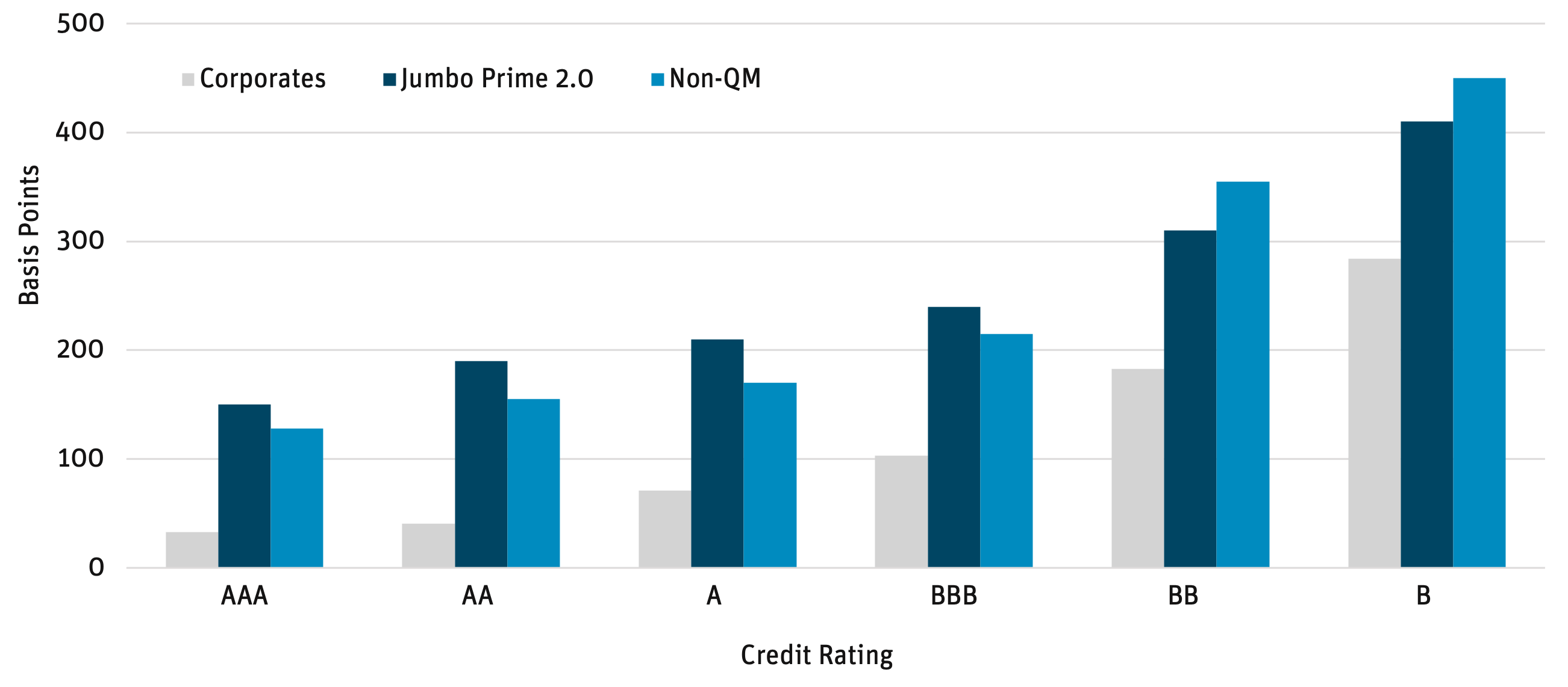

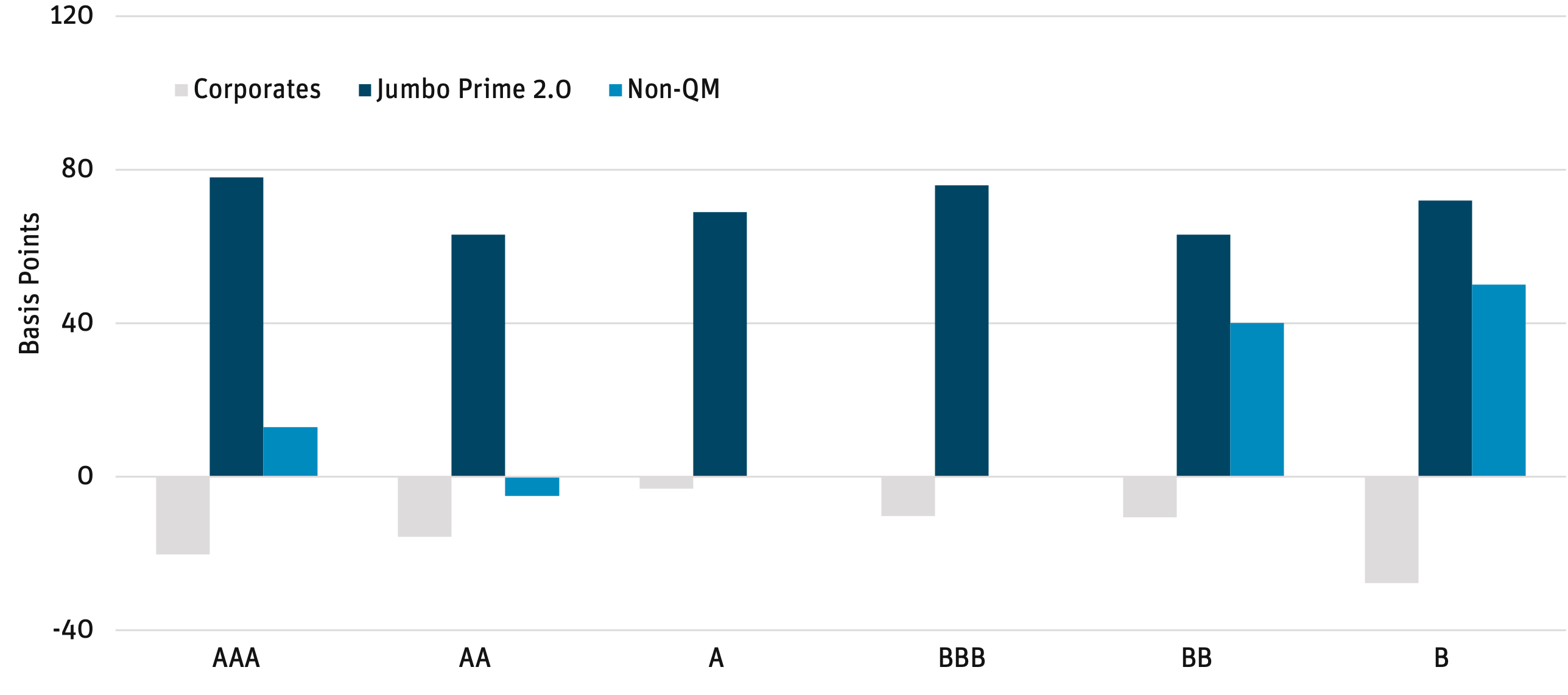

While we recognize there are differences between corporate and mortgage debt, the relative value jumps off the page. Nominal current coupon agency mortgage spreads trade significantly wider than The Bloomberg U.S. Corporate Investment Grade Index and have government backing (Figure 2). Moreover, new-issue non-agency mortgages sectors, such as jumbo prime 2.0 and non-QM, offer considerable yield pickup over similarly rated corporates (Figure 3). Spreads in new issuance non-agency mortgages are still trading wider than before the Fed started raising rates, while corporate bonds are tighter (Figure 4). We believe current spread levels offer a very attractive entry point in the space.

Figure 2: Current Coupon Agency Spread Wider Than IG Corp. Spread

Source: Bloomberg, Morgan Stanley Research as of 5/31/24.

Figure 3: NA Mortgage vs. Corporate Spreads

Figure 4: Change vs. 12/31/21: NA Mortgage vs. Corporate Spreads

Source: Bloomberg, Wells Fargo as of 5/31/24.

Our focus on sustainable fundamentals in high-quality areas of securitized credit positions us to potentially outperform over the long-run credit cycle, as current market dynamics provide the opportunity for both income and capital appreciation potential in the wake of the bond bear market of 2022. We believe the relative value of securitized mortgage credit stands out across risk assets when considering where to invest fixed-income dollars in 2024 and recommend investors step out of cash into longer-duration assets sooner than later for potential outperformance.

DEFINITIONS AND DISCLOSURES

Agency Mortgage-Backed Securities (AMBS): Securities issued or guaranteed by the U.S. government or a GSE.

Bloomberg U.S. Corporate Investment Grade Index: An index that measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD-denominated securities publicly issued by U.S. and non-U.S. industrial, utility and financial issuers.

Current Coupon: Refers to a security that is trading closest to its par value without going over par. In other words, the bond’s market price is at or near to its issued face value.

Morgan Stanley 30Y Conventional Current Coupon ($100) ZV Index: The index represents the ZV (zero volatility) spread for the hypothetical $100-priced 30-year conventional mortgage over time.

Mortgage-Backed Security (MBS): A type of asset-backed security which is secured by a mortgage or collection of mortgages.

Non-Qualified Mortgage (Non-QM): A loan that does not meet the standards of a qualified mortgage and uses non-traditional methods of income verification to help a borrower get approved for a home loan.

Prime Jumbo: Prime jumbo mortgages are non-agency loans typically because the lending amount exceeds the conforming loan limits. These tend to be high-quality mortgages with high credit scores that, for the most part, comply with agency mortgage underwriting guidelines.

Opinions expressed are as of 5/31/24 and are subject to change at any time, are not guaranteed, and should not be considered investment advice.

Investing involves risk; principal loss is possible. Investments in debt securities typically decrease when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower-rated and nonrated securities present a greater risk of loss to principal and interest than do higher-rated securities. Investments in asset-backed and mortgage-backed securities include additional risks that investors should be aware of, including credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Derivatives involve risks different from — and in certain cases, greater than — the risks presented by more traditional investments. Derivatives may involve certain costs and risks such as illiquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lead to losses that are greater than the amount invested. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. The Fund may use leverage, which may exaggerate the effect of any increase or decrease in the value of securities in the Fund’s portfolio or the Fund’s net asset value, and therefore may increase the volatility of the Fund. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are increased for emerging markets. Investments in fixed-income instruments typically decrease in value when interest rates rise. The Fund will incur higher and duplicative costs when it invests in mutual funds, ETFs and other investment companies. There is also the risk that the Fund may suffer losses due to the investment practices of the underlying funds. For more information on these risks and other risks of the Fund, please see the Prospectus.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Angel Oak Funds. This and other important information about each Fund is contained in the Prospectus or Summary Prospectus for each Fund, which can be obtained by calling 855-751-4324 or by visiting www.angeloakcapital.com. The Prospectus or Summary Prospectus should be read carefully before investing.

Index performance is not indicative of Fund performance. Past performance does not guarantee future results. Current performance can be obtained by calling 855-751-4324.

The Angel Oak Funds are distributed by Quasar Distributors, LLC.

© 2024 Angel Oak Capital Advisors, which is the adviser to the Angel Oak Funds.