We believe securitized credit continues to be an underrepresented asset class within retail investors’ fixed income portfolios. Institutional investors typically have a greater allocation to the asset class relative to corporate credit. The figures below illustrate one key benefit institutional investors have enjoyed; securitized credit tends to earn a premium to corporate credit. We call this potential outperformance the securitized credit premium.

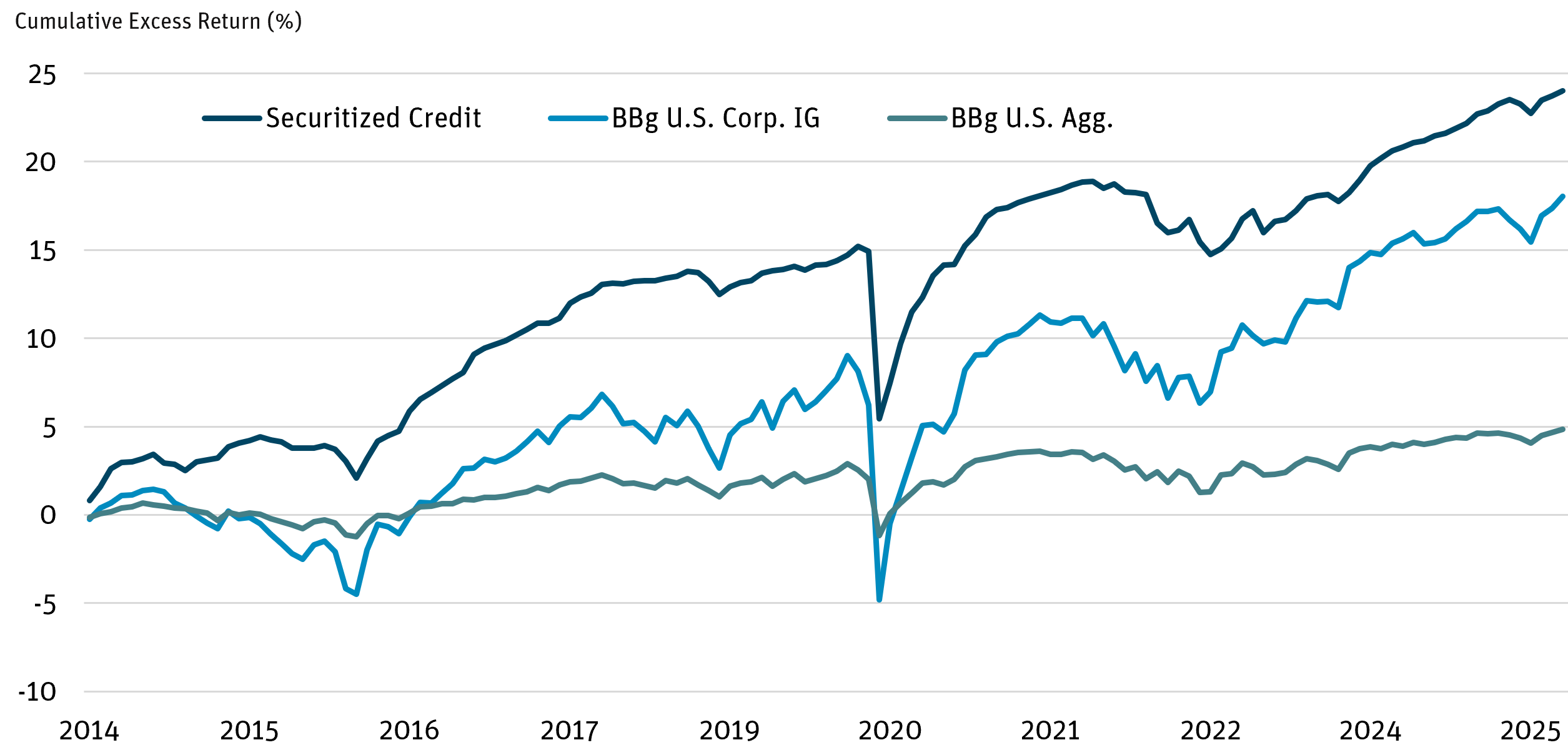

Figure 1: Securitized Credit Has Historically Outperformed Corporate Credit

Source: BofA Global Research as of 9/30/25.

This premium can vary over time. During periods of volatility, we believe patient investors that hold through the credit cycle have the potential to achieve attractive returns. While there can be periods of underperformance, securitized credit tends to outperform corporate credit on average, even after adjusting for risk, as shown in Figure 2.

There are several potential drivers of the securitized credit premium, including:

- Lack of representation in fixed income indices, such as the Bloomberg U.S. Aggregate Bond Index, which causes a liquidity premium.

- Complexity of the underlying structures causes less sophisticated investors to potentially shy away from the securities.

- Securitized credit securities tend to cash flow on a monthly basis versus more traditional fixed income that receives cash at maturity.

Figure 2: Risk-Adjusted Returns for Structured Credit vs. U.S. Corp. IG and U.S. Agg.

Source: BofA Global Research from 1/31/14 through 9/30/25.

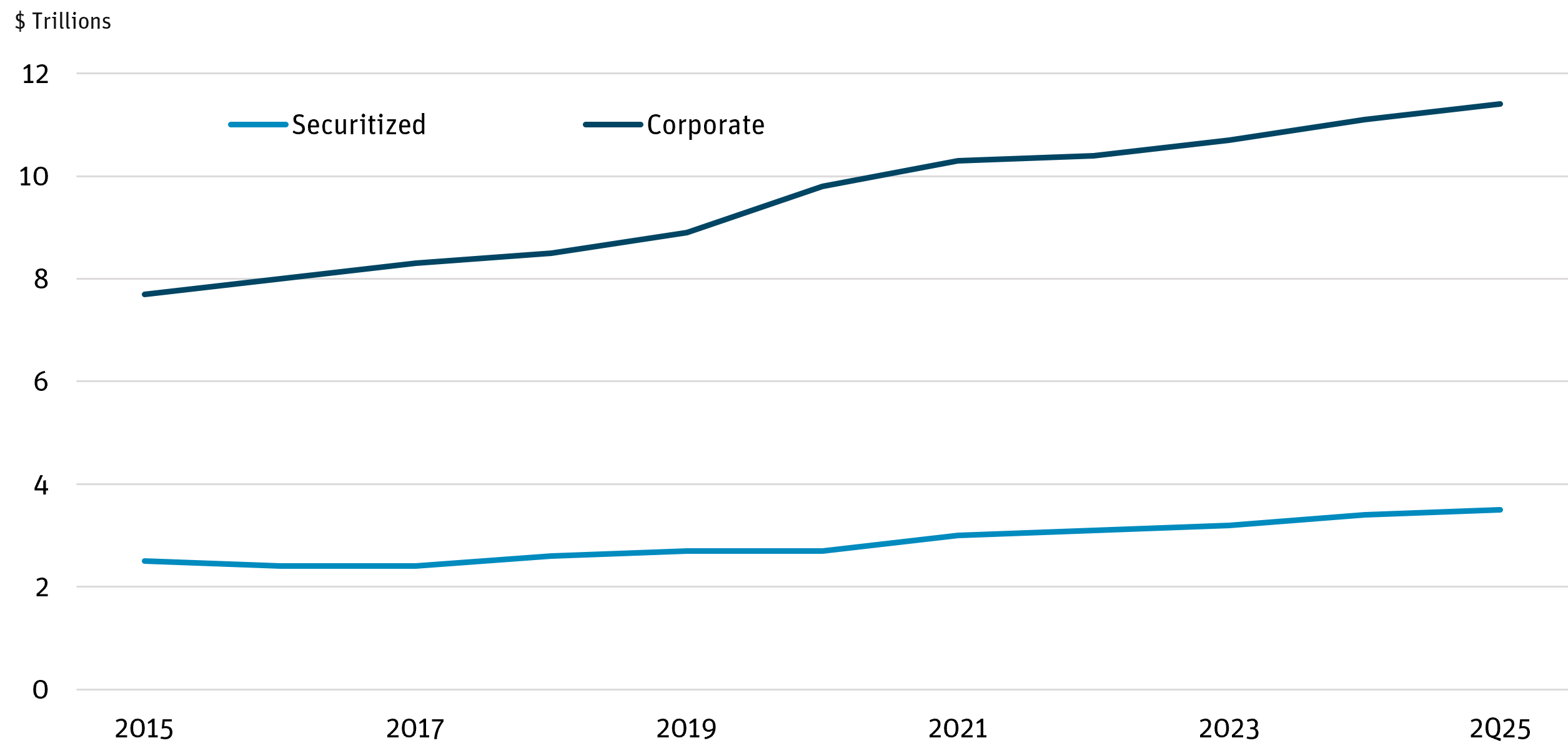

One of the main concerns investors have about securitized credit is the havoc it caused within portfolios during the Great Financial Crisis. However, since the crisis, the securitized credit markets have become more regulated, underwriting standards have tightened, and issuers must have “skin in the game” or risk retention. These changes have caused the market to experience very little growth compared with the corporate credit marketplace.

Figure 3: Outstanding Debt in Securitized and Corporate Credit Markets

Source: SIFMA, BOA Research as of 9/30/25.

We believe retail investors, who tend to be under allocated to securitized credit, should consider increasing their allocation to the asset class to help diversify their fixed income allocation and potentially increase their portfolio’s overall risk-adjusted return.

DEFINITIONS AND DISCLOSURES

Bloomberg U.S. Aggregate Bond Index:An unmanaged index that measures the performance of the investment-grade universe of bonds issued in the United States. The index includes institutionally traded U.S. Treasury, government sponsored, mortgage and corporate securities.

Bloomberg U.S. Corporate Investment Grade Index: An index that measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD- denominated securities publicly issued by U.S. and non-U.S. industrial, utility and financial issuers.

Cash Flow:The net amount of cash and cash-equivalents being transferred into and out of a business, especially as affecting liquidity.

Sharpe Ratio: A statistical measure that uses standard deviation and excess return to determine reward per unit of risk. A higher Sharpe ratio implies a better historical risk-adjusted performance. The Sharpe ratio has been calculated since inception using the 3-month Treasury bill for the risk-free rate of return.

The Securitized Products Return Indicator aggregates monthly return performance across the U.S. securitized products credit markets that Bank of America tracks into one number for both total return and excess swap return. The Agency MBS market is not included in the Indicator as it is focused on the return of non-guaranteed securities. There are two subsets of the indicator: 1) a AAA Indicator that tracks AAA-rated structured credit bonds and 2) a Down in Credit Indicator which tracks CLO BBB/BB tranches, CMBS BBB tranches and CAS/STACR below investment-grade rated bonds. The return data is weighted by the 1-month lagged outstanding par value of each indicator constituent. This methodology also applies to the two subset indicators.

Opinions expressed are as of 9/30/25 and are subject to change at any time, are not guaranteed, and should not be considered investment advice.

Investing involves risk; principal loss is possible. Investments in debt securities typically decrease when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower-rated and nonrated securities present a greater risk of loss to principal and interest than do higher-rated securities. Investments in asset-backed and mortgage-backed securities include additional risks that investors should be aware of, including credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Derivatives involve risks different from — and in certain cases, greater than — the risks presented by more traditional investments. Derivatives may involve certain costs and risks such as illiquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lead to losses that are greater than the amount invested. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. The Fund may use leverage, which may exaggerate the effect of any increase or decrease in the value of securities in the Fund’s portfolio or the Fund’s net asset value, and therefore may increase the volatility of the Fund. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are increased for emerging markets. Investments in fixed-income instruments typically decrease in value when interest rates rise. The Fund will incur higher and duplicative costs when it invests in mutual funds, ETFs and other investment companies. There is also the risk that the Fund may suffer losses due to the investment practices of the underlying funds. For more information on these risks and other risks of the Fund, please see the Prospectus.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Angel Oak Mutual Funds. This and other important information about each Fund is contained in the Prospectus or Summary Prospectus for each Fund, which can be obtained by calling 855-751-4324 or by visiting www.angeloakcapital.com. The Prospectus or Summary Prospectus should be read carefully before investing.

Index performance is not indicative of Fund performance. Past performance does not guarantee future results. Current performance can be obtained by calling 855-751- 4324.

The Angel Oak Funds are distributed by Quasar Distributors, LLC.

© 2025 Angel Oak Capital Advisors, which is the adviser to the Angel Oak Funds.