This primer examines the structure and dynamics of the U.S. corporate credit market, highlighting the performance drivers across investment-grade and high-yield debt. It emphasizes that disciplined credit selection, structural awareness, and active management are essential for generating value and mitigating risk in a tight spread environment.

Executive Summary

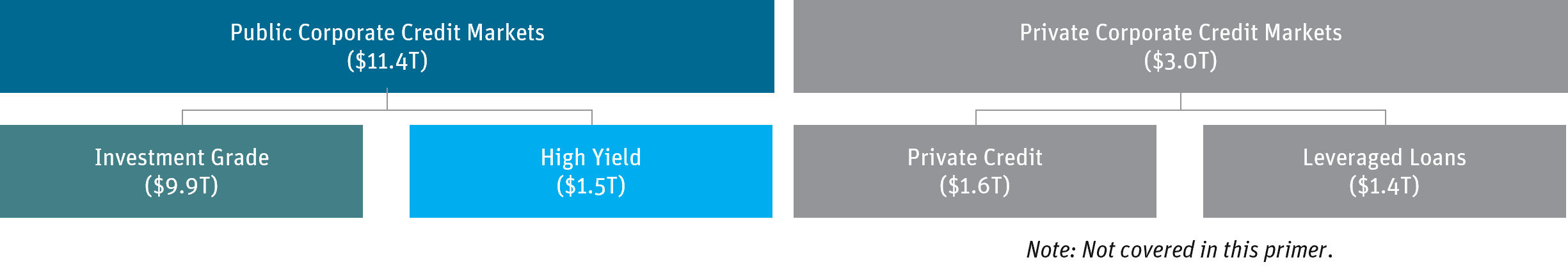

I. Introduction to Corporate Credit: Corporate credit refers to the market for debt instruments issued by corporations to finance operations, acquisitions, and growth. It encompasses investment-grade and high-yield bonds as well as leveraged loans and private credit, offering a wide spectrum of risk-return profiles. Corporate credit is a cornerstone of the capital markets, enabling companies to access scalable funding while providing investors with income, diversification, and exposure to credit risk. (Note: The primer does not evaluate private credit or leveraged loans.)

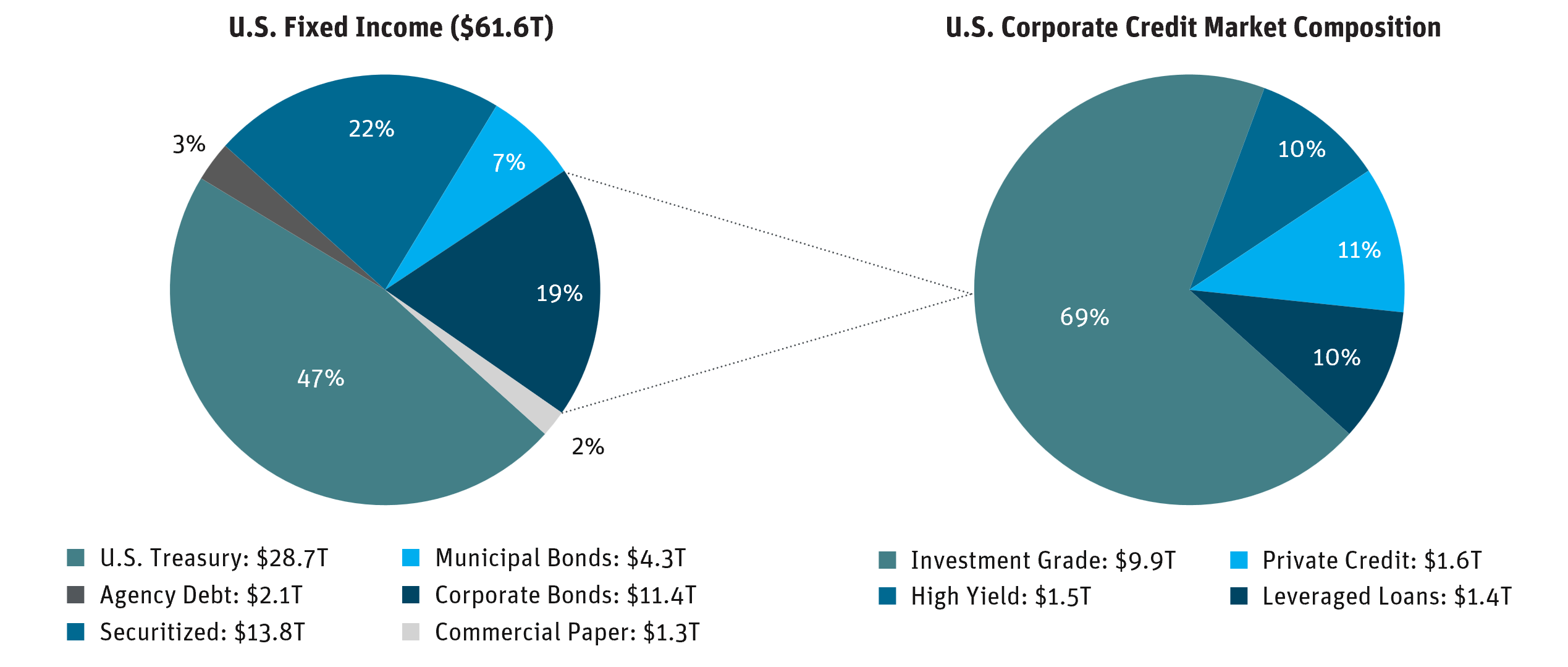

II. Segmentation and Size of Public Corporate Credit Markets: Investment-grade bonds (rated Baa3/BBB- or higher) account for approximately $9.9 trillion of the U.S. fixed income market. They are characterized by lower risk and yields, longer maturities, strong liquidity, and minimal default risk. In contrast, the high-yield bond segment is smaller at roughly $1.5 trillion but offers higher potential returns, reflecting greater credit and liquidity risk relative to investment-grade bonds.

III. Corporate Credit Issuance Process: The issuance process begins with identifying capital needs, followed by structuring, credit rating, syndication, and offering securities to investors. Debt instruments are governed by legal agreements (such as indentures or credit agreements) and may incorporate features like covenants, collateral, call protection, and guarantees. After issuance, investors monitor credit performance, market pricing, and covenant compliance, through either the secondary market or direct engagement with issuers.

IV. Corporate Credit Strategies: Post-global financial crisis (GFC) reforms and greater investor sophistication have reshaped the corporate credit landscape. Despite periods of volatility, the asset class continues to offer opportunities for yield enhancement, credit selection, and event-driven strategies. Structural innovations and regulatory discipline have also strengthened transparency and resilience, reinforcing corporate credit’s role as a core allocation within fixed income portfolios.

V. Analyzing Corporate Credit: Evaluating corporate bonds requires a range of analytical tools to assess risks and opportunities. Key considerations include financial statement analysis, the issuer’s competitive positioning, the quality of leadership, and the specific terms of the issuance. Investors also interpret external inputs such as credit ratings and market-based signals, including potential total returns and spread levels.

VI. Opportunities in Corporate Credit: With spreads at historically tight levels, uncovering attractive opportunities in corporate credit requires skill, experience, and disciplined credit selection.

I. Introduction to Corporate Credit

Corporate credit encompasses the universe of debt instruments issued by corporations to raise capital for a variety of purposes, including funding operations, refinancing existing obligations, mergers and acquisitions (M&A), and general corporate needs. These instruments span the credit spectrum from investment grade to high yield and represent a foundational component of the global fixed income markets.

For investors, corporate credit offers a wide range of risk-return profiles, shaped by the credit quality of the issuer, the structure of the instrument, and prevailing market conditions. Beyond its role in corporate financing, the asset class provides valuable tools for portfolio diversification and yield enhancement across both institutional and retail strategies.

The public corporate credit segment includes registered and Rule 144a securities issued by companies in two primary categories:

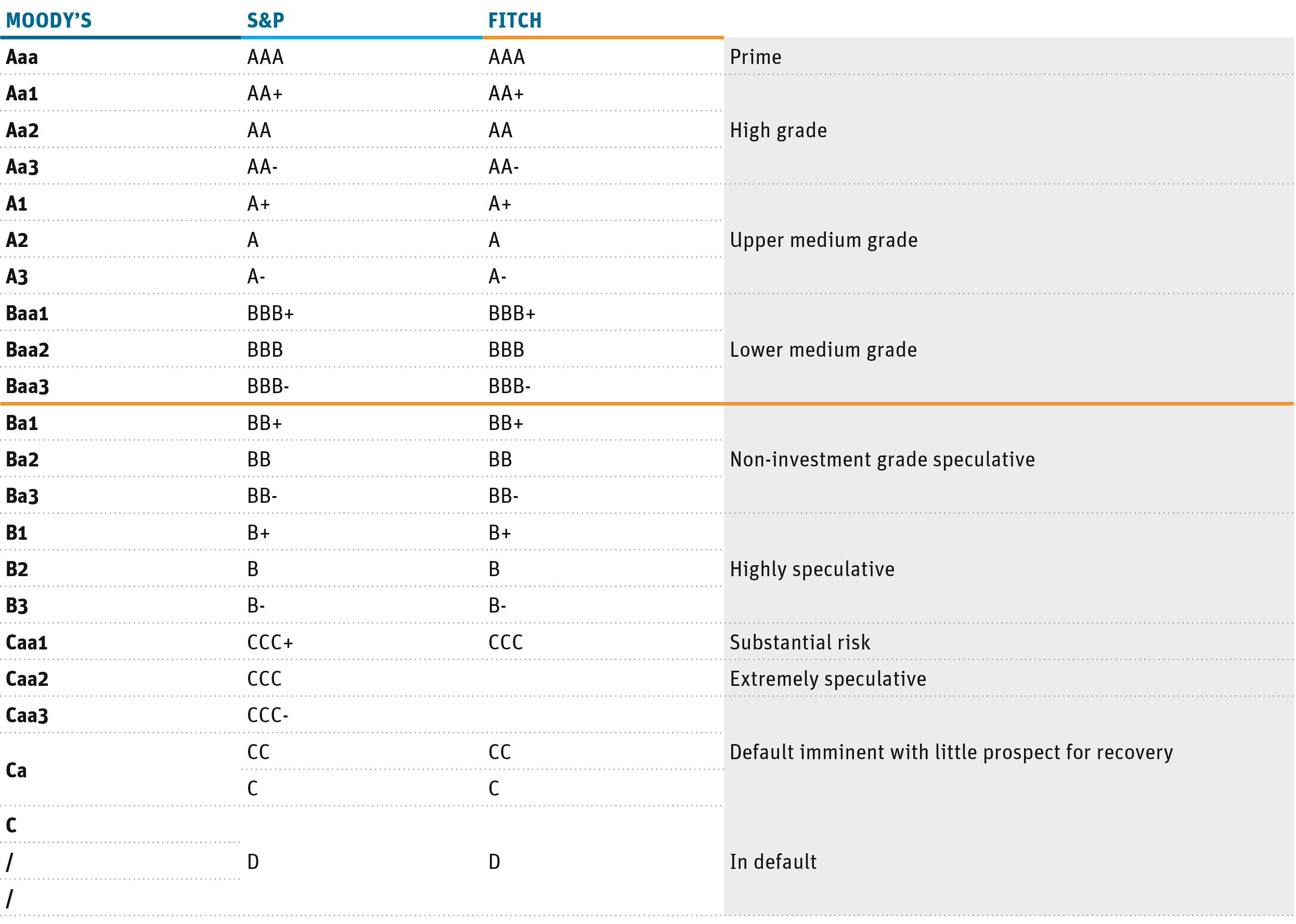

- Investment grade: Rated Aaa/AAA+ through Baa3/BBB- by a nationally recognized statistical rating organization (NRSRO) such as S&P, Fitch, or Moody’s.

- High yield (non-investment grade): Rated Ba1/BB+ through Caa3/CCC-, often referred to as the speculative-grade or high-yield segment.

By contrast, the private credit market includes direct lending from asset managers, insurers, and pension funds, as well as leveraged loans (senior secured bank loans to below-investment-grade issuers, frequently used in leveraged buyouts (LBOs), M&A, or recapitalizations). This primer focuses on public credit, with private credit to be addressed in a future publication.

II. Segmentation and Size of Public Corporate Credit Markets

Investment-Grade (IG) Bonds: Corporate (or sovereign) bonds rated BBB-/Baa3 or higher. These securities are considered lower risk, with a strong capacity to meet financial commitments, and are a core component of conservative fixed income portfolios.

Key Benefits |

Key Risks |

|---|---|

|

|

High-Yield (HY) Bonds: Corporate securities rated below investment grade (BB+/Ba1 or lower). These bonds compensate investors with higher yields in exchange for greater credit risk, often tied to weaker financial profiles or leveraged transactions.

Key Benefits |

Key Risks |

|---|---|

|

|

Sidebar: Credit Derivatives

Credit derivatives allow investors to manage or transfer credit risk without owning the underlying bond.

- Credit Default Swaps (CDS): The most common form of credit derivatives, functioning like insurance against borrower default. CDS contracts are widely used by banks, hedge funds, and institutional investors for both hedging and speculative strategies. While they increase flexibility in risk management, CDS also introduce counterparty and systemic risks.

- Credit Default Swap Indices (CDX): Standardized baskets of CDS linked to corporate issuers (e.g., CDX IG, CDX HY). Investors can buy protection to hedge or sell protection to gain exposure. These contracts are typically centrally cleared, helping to improve liquidity and reduce counterparty risk.

Market Data

Source: SIFMA as of 6/30/25 (U.S. Fixed Income); Source: BofA Global Research as of 6/30/25 (U.S. Corporate Credit Market Composition).

III. Corporate Credit Issuance Process

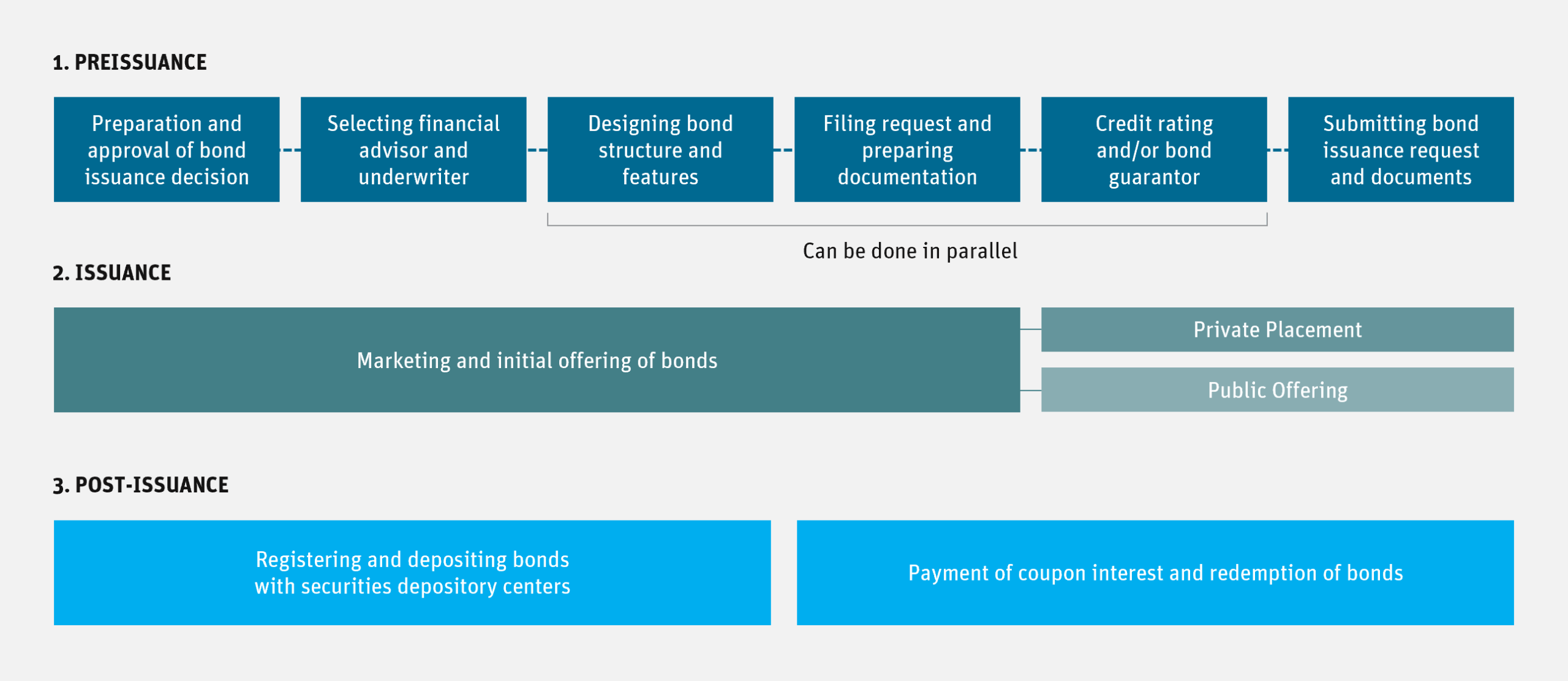

Companies raise debt by issuing corporate bonds. Over time, the corporate debt market has developed a standardized framework for structuring and distributing securities, balancing issuer financing needs with investor protections. Investors conduct due diligence before purchase, and they may later adjust exposures by trading in the secondary market. Strong documentation standards, investor safeguards, and efficient market infrastructure are critical in facilitating both primary issuance and ongoing liquidity.

Key Steps in the Issuance Process:

Debt Origination: A corporation identifies a funding need—such as refinancing existing debt, financing M&As, or supporting working capital—and engages a syndicate of investment banks to raise capital. The company’s financial profile, credit rating, and prevailing market conditions influence the structure of the instrument (e.g., investment grade vs. high yield, fixed vs. floating rate, callable vs. convertible).

Structuring and Syndication: Issuers generally work with a syndicate of investment banks—often led by a designated arranger or lead bank—to structure and market the debt offering. Key terms include:

- Seniority: Secured vs. unsecured claims.

- Tenor: Short- vs. long-term maturities.

- Coupon: Fixed vs. floating interest payments.

- Callability: Optional redemption features.

- Covenants: Maintenance- or incurrence-based protections.

- Guarantees: Parental or third-party credit support.

The offering is marketed to institutional investors through road shows, giving potential buyers the opportunity to evaluate the terms. In some cases, transactions are issued as direct or private placements to pre-identified investors, provided that certain requirements are met.

Documentation: Bond indentures serve as contracts between the issuer and a trustee representing investors. These agreements typically specify:

- Core terms: Principal amount, coupon rate, payment frequency, and maturity date.

- Affirmative covenants: Obligations such as maintaining insurance or providing audited financials.

- Negative covenants: Restrictions on incurring additional debt, paying excessive dividends, and selling key assets.

- Call/put provisions: Early redemption by the issuer or repayment options for investors.

- Default clauses: Events of default and remedies available to investors.

- Trustee role: Oversight of compliance and enforcement on behalf of bondholders.

- Governing law: Legal jurisdiction for enforcement.

Rating Agencies: NRSROs assign ratings assessing the creditworthiness of both the issuer and the specific instrument. Ratings strongly influence investor demand and pricing.

Issuance and Distribution: Bonds are placed in the primary market, with allocations determined by the underwriting syndicate. Investor demand is gauged through order books built during the marketing process.

Secondary Markets: After issuance, corporate bonds trade in the secondary market, where liquidity varies by rating, size, and structure. Investors continuously monitor:

- Issuer financial performance and covenant compliance.

- Credit rating upgrades or downgrades.

- Market pricing, spreads, and relative value vs. benchmarks.

- Relative derivatives activity (e.g., CDS referencing the bond).

The growth of electronic trading platforms and portfolio trading has improved liquidity and efficiency in the secondary market.

Refinancing or Maturity: Issuers may refinance bonds before maturity to reduce borrowing costs or extend duration. Callable bonds provide flexibility in a declining rate environment, though investors face reinvestment risk when bonds are called. At maturity, principal is repaid to bondholders unless refinancing or restructuring occurs.

Credit Rating Scales by Agency, Long-Term

The Benefits of Public Corporate Credit Markets

For Issuers:

- Capital Access and Flexibility: Scalable, non-dilutive funding options support strategic objectives such as M&A, refinancing, and growth.

- Cost Efficiency: Debt financing is generally more cost-effective than equity, as interest payments are tax-deductible. Investment-grade issuers, in particular, benefit from low borrowing costs.

- Diversified Investor Base: Attracts a broad spectrum of investors—including insurance companies, pension funds, mutual funds, ETFs, collateralized loan obligations, and international participants— enhancing market depth and pricing efficiency.

- Customizable Structures: Instruments can be tailored by maturity, coupon type, callability, and covenant strength to align with issuer strategies.

- Market Signaling: Maintaining an investment-grade rating or demonstrating disciplined capital structure management can enhance corporate reputation and investor confidence.

For Investors:

- Yield and Risk Spectrum: Corporate credit provides a wide range of risk-return profiles, from lower-risk investment-grade bonds to higher-yielding speculative-grade debt.

- Liquidity and Transparency: Public bonds trade in regulated markets with robust price discovery, while ETFs and credit derivatives (e.g., CDS) further enhance access, hedging, and risk assessment.

- Portfolio Diversification: Exposure to a broad set of issuers and sectors provides diversification relative to government bonds and equities.

Risk Factors in Corporate Credit

Attractive yields in corporate credit compensate investors for exposure to several key risk factors:

- Credit Risk: There is risk of issuer default due to weak financial performance, macroeconomic downturns, or idiosyncratic events (fraud, litigation, natural disasters). High-yield issuers generally carry higher leverage and weaker fundamentals, with recovery rates influenced by seniority, collateral, industry dynamics, and bankruptcy proceedings.

- Liquidity Risk: IG bonds are generally liquid, but HY bonds may trade less frequently. Liquidity risk intensifies during market stress, widening bid-ask spreads and reducing trading volumes.

- Interest Rate Risk: Fixed-rate bonds are sensitive to interest rate changes. Rising rates can create mark-to-market losses, particularly for longer-duration IG bonds. Floating-rate instruments provide some protection but may still face spread compression or refinancing risk.

- Covenant Risk: Weakly documented or absent covenants reduce protections, exposing investors to higher risk.

- Event Risk: Sudden, issuer-specific events—such as LBOs, dividend recapitalizations, regulatory penalties, and leadership changes—can materially alter credit profiles, often leading to spread widening or downgrades.

IV. Corporate Credit Strategies

Sources of Opportunity: Over the credit cycle, corporate credit can deliver attractive risk-adjusted returns, particularly for investors selective about credit quality, structure, and timing. Drivers of opportunity include:

- Relative Value: Differences in credit quality, capital structure, and covenant strength across issuers create opportunities for alpha through security selection.

- Rating Migration: Upgrades (rising stars) and downgrades (fallen angels) can create pricing dislocations. Investors who anticipate or react quickly may benefit from spread compression or forced selling.

- Event-Driven Opportunities: M&A, LBOs, recapitalizations, and liability management can generate mispricing or favorable new issuance.

Current Relative Value Drivers:

- Yield Pickup: Corporate bonds often provide higher yields than government or agency debt, especially in a rising rate environment.

- Strengthened Credit Fundamentals: Balance sheets across many sectors have improved post-pandemic, reducing default risk.

- Market Volatility: While equity markets fluctuate, corporate credit often provides more stable cash flows.

- Spread Compression Opportunities: Active selection allows investors to benefit from narrowing spreads.

Structural and Regulatory Considerations:

- Post-GFC Reforms: Basel III, the Volcker Rule, and enhanced disclosure requirements have improved transparency and reduced systemic risk. However, these reforms have also reduced bank inventories of corporate bonds and market-making capacity.

- Covenant Awareness: Though covenant-lite structures have grown, investor scrutiny has increased. Challenges remain, including “creditor on creditor violence,” where structural loopholes are exploited.

V. Analyzing Corporate Credit

A thorough assessment of corporate bonds requires evaluating both quantitative and qualitative factors that influence an issuer’s ability and willingness to meet its obligations. The following framework outlines key areas of focus:

- Financial Statement Analysis – Overall Health:

- Profitability: Metrics such as gross margin, EBITDA margin, and return on assets indicate the issuer’s ability to generate earnings from revenues.

- Leverage: Ratios like debt-to-equity and debt-to-EBITDA measure the sustainability of a company’s capital structure and its capacity to service debt.

- Liquidity Sources: Availability of cash on balance sheet and committed bank facilities relative to upcoming maturities and capital needs.

- Cash Flow: Free cash flow relative to debt, along with interest coverage ratios, is critical to assessing the issuer’s ability to meet principal and interest obligations.

- Business Model – Competitive Advantages:

- Market Position: Companies with defensible competitive advantages (e.g., brand strength, proprietary technology, cost leadership) are better positioned to maintain profitability.

- Revenue Diversification: Broader geographic, product, and customer diversification reduces reliance on single revenue streams.

- Industry Cyclicality: Firms operating in cyclical sectors may experience greater earnings volatility during downturns.

- Regulatory and Technological Risks: Exposure to disruptive regulation or new technologies can materially impact creditworthiness.

- Management Quality and Governance – Leadership:

- Track Record: Demonstrated ability of management to execute strategy, maintain discipline, and deliver results.

- Corporate Governance: Independent oversight, transparent reporting, and shareholder-aligned practices.

- Risk Management: Systems to identify, monitor, and mitigate financial, operational, and strategic risks.

- Legal/Compliance: Adherence to regulatory standards and effective handling of litigation exposure.

- Debt Structure and Covenants – Terms of Credit:

- Maturity Profile: A balanced debt maturity schedule reduces refinancing pressures and enhances financial flexibility.

- Interest Rate Exposure: Composition of fixed- vs. floating-rate debt affects sensitivity to interest rate changes.

- Covenants: Protective covenants (e.g., restrictions on additional leverage, minimum coverage ratios) offer investor safeguards but may limit corporate flexibility.

- Subordination: Senior debt holders benefit from priority in repayment, while subordinated holders bear higher risk in distress.

- External Signals – Credit Ratings and Market Data:service debt.

- Credit Ratings: Independent assessments by NRSROs provide benchmarks for issuer credit quality.

- Yields and Spreads: Comparison of issuer yields versus those of peers and market benchmarks reflects relative credit risk.

- Equity Market Performance: The issuer’s stock valuation, volatility, and investor sentiment often provide complementary signals to credit markets.

VI. Opportunities in Corporate Credit

Corporate credit spreads are historically tight, meaning investors receive less compensation for risk. Nonetheless, opportunities exist for disciplined investors:

- Focus on Absolute Yields, Not Just Spreads: Even in a tight spread environment, absolute yields remain attractive by recent historical standards. For example, the Bloomberg U.S. Corporate Investment Grade Index carries a yield-to-worst (YTW) of 4.81%, while the Bloomberg U.S. Corporate High Yield Bond Index offers a YTW of 6.69%. Locking in these yields can provide compelling income relative to comparable fixed income alternatives.

- Minimize Interest Rate Sensitivity: Many high-yield issuers structure shorter-maturity, callable securities, enabling refinancing once credit profiles improve and spreads tighten. These shorter-dated, callable structures also help reduce exposure to rate volatility if inflation accelerates or fiscal deficits expand.

- Prioritize Credit Quality and Fundamentals: With spreads offering limited downside protection, careful selection is paramount. Emphasis should be placed on issuers with strong balance sheets, healthy interest coverage, and reliable cash flow generation, while those engaging in aggressive leverage or financial engineering should be avoided.

- Higher-Quality HY Segment: The composition of the high-yield market has shifted toward stronger issuers, with a greater proportion of bonds now rated BB/Ba. This structural improvement provides justification for tighter spreads relative to prior cycles.

- Manager Selection: For investors allocating to corporate credit-focused funds, choosing managers with the ability to identify fundamentally sound but less liquid issuers can add value. These positions often carry yield and spread premiums that enhance performance in benign markets while demonstrating resilience in downturns.

Agency: Refers to securities, either direct debt obligations or pools of mortgage loans, that are issued or guaranteed by government-sponsored enterprises like Fannie Mae, Freddie Mac, or Ginnie Mae.

Basel III: An international regulatory accord designed to improve the regulation, supervision, and risk management of the banking sector in the wake of the global financial crisis.

Bid/Ask Spread: The difference between the price buyers are willing to pay and the price sellers are asking, reflecting transaction costs and market liquidity.

Bloomberg U.S. Corporate High Yield Bond Index: An unmanaged market value-weighted index that covers the universe of fixed-rate, non-investment-grade debt.

Bloomberg U.S. Corporate Investment Grade Index: An index that measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD- denominated securities publicly issued by U.S. and non-U.S. industrial, utility and financial issuers.

Cash Flow: The net amount of cash and cash-equivalents being transferred into and out of a business, especially as affecting liquidity.

Collateralized Loan Obligation (CLO): A single security backed by a pool of debt.

Debt-to-EBITDA Ratio: Measures the amount of income generated and available to cover debt before covering interest, taxes, depreciation and amortization expenses.

EBITDA: Earnings before interest, taxes, depreciation, and amortization.

Floating Rate: A floating-rate security is an investment with interest payments that float or adjust periodically based upon a predetermined benchmark.

Free Cash Flow: The money a company has left after paying its operating expenses and capital expenditures.

Leveraged Buyout (LBO): The acquisition of a company using a large amount of borrowed money, where the company’s assets and cash flows are used to secure and repay the debt.

Mergers & Acquisitions (M&A): The process of consolidating companies or their major assets through various financial transactions, including a merger (where two or more companies combine into one new entity) or an acquisition (where one company buys another).

Spread: The difference in yield between two bonds of similar maturity but different credit quality.

Yield-to-Worst (YTW): The lowest potential yield that can be received on a bond without the issuer actually defaulting.

Yield Pickup: The increase in return that an investor earns by switching from one investment to another with a higher yield, typically involving greater risk or longer maturity.

Yield Premium: The additional return that an investor can potentially earn from investing in a bond with higher risk compared to a similar bond with lower risk.

Opinions expressed are as of 9/30/25 and are subject to change at any time, are not guaranteed, and should not be considered investment advice.

Investing involves risk; principal loss is possible. Investments in debt securities typically decrease when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower-rated and nonrated securities present a greater risk of loss to principal and interest than do higher-rated securities. Investments in asset-backed and mortgage-backed securities include additional risks that investors should be aware of, including credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Derivatives involve risks different from — and in certain cases, greater than — the risks presented by more traditional investments. Derivatives may involve certain costs and risks such as illiquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lead to losses that are greater than the amount invested. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. The Fund may use leverage, which may exaggerate the effect of any increase or decrease in the value of securities in the Fund’s portfolio or the Fund’s net asset value, and therefore may increase the volatility of the Fund. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are increased for emerging markets. Investments in fixed-income instruments typically decrease in value when interest rates rise. The Fund will incur higher and duplicative costs when it invests in mutual funds, ETFs and other investment companies. There is also the risk that the Fund may suffer losses due to the investment practices of the underlying funds. For more information on these risks and other risks of the Fund, please see the Prospectus.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Angel Oak Funds. This and other important information about each Fund is contained in the Prospectus or Summary Prospectus for each Fund, which can be obtained by calling 855-751-4324 or by visiting www.angeloakcapital.com. The Prospectus or Summary Prospectus should be read carefully before investing.

Ratings provided by S&P, Moody’s, Fitch, KBRA, DBRS Morningstar, Egan-Jones, and AM Best. Ratings are expressed as letters ranging from AAA, which is the highest grade, to D, which is the lowest grade. If the rating agencies rate a security differently, the adviser uses the highest rating. When a rating agency has not issued a formal rating, the adviser will classify the security as non-rated.

Index performance is not indicative of Fund performance. Past performance does not guarantee future results. Current performance can be obtained by calling 855-751- 4324.

The Angel Oak Funds are distributed by Quasar Distributors, LLC.

© 2025 Angel Oak Capital Advisors, which is the adviser to the Angel Oak Funds.