The Federal Reserve announced a 50 basis point cut to the federal funds rate, from 5.25% to 4.75%, in line with market expectations, as the Fed expressed greater confidence in cooling inflation and supporting maximum employment. With short-term rates still restrictive, inflation moving closer to 2%, and a cooling labor market, we believe this marks the start of a cutting cycle.

2024 has so far provided an excellent environment for high-quality short- and intermediate-duration bond strategies, which have outperformed cash by a large margin. With additional rate declines expected over the course of the next year, money market income may decline rapidly. Investors should favor investment-grade, fixed-rate securitized credit to lock in current yields. While corporate credit valuations appear rich, investment-grade securitized credit still has room to run.

Encouragingly, the latest economic news continues to show that the disinflation trend is on track. The August 2024 Consumer Price Index (CPI) rose 2.5% year over year, the smallest annual increase since February 2021 (Figure 1). With the unemployment rate ticking up to 4.2% from 3.7% at the start of 2024, Federal Reserve Chairman Jerome Powell confirmed that “downside risks to employment have increased” and that the Fed does not “seek or welcome further cooling in labor market conditions.” At this stage, the trajectory of interest rates is still expected to be lower, a trend that historically has supported bond prices.

Figure 1: U.S. Consumer Price Index (YoY%)

Source: Bloomberg as of 8/31/24.

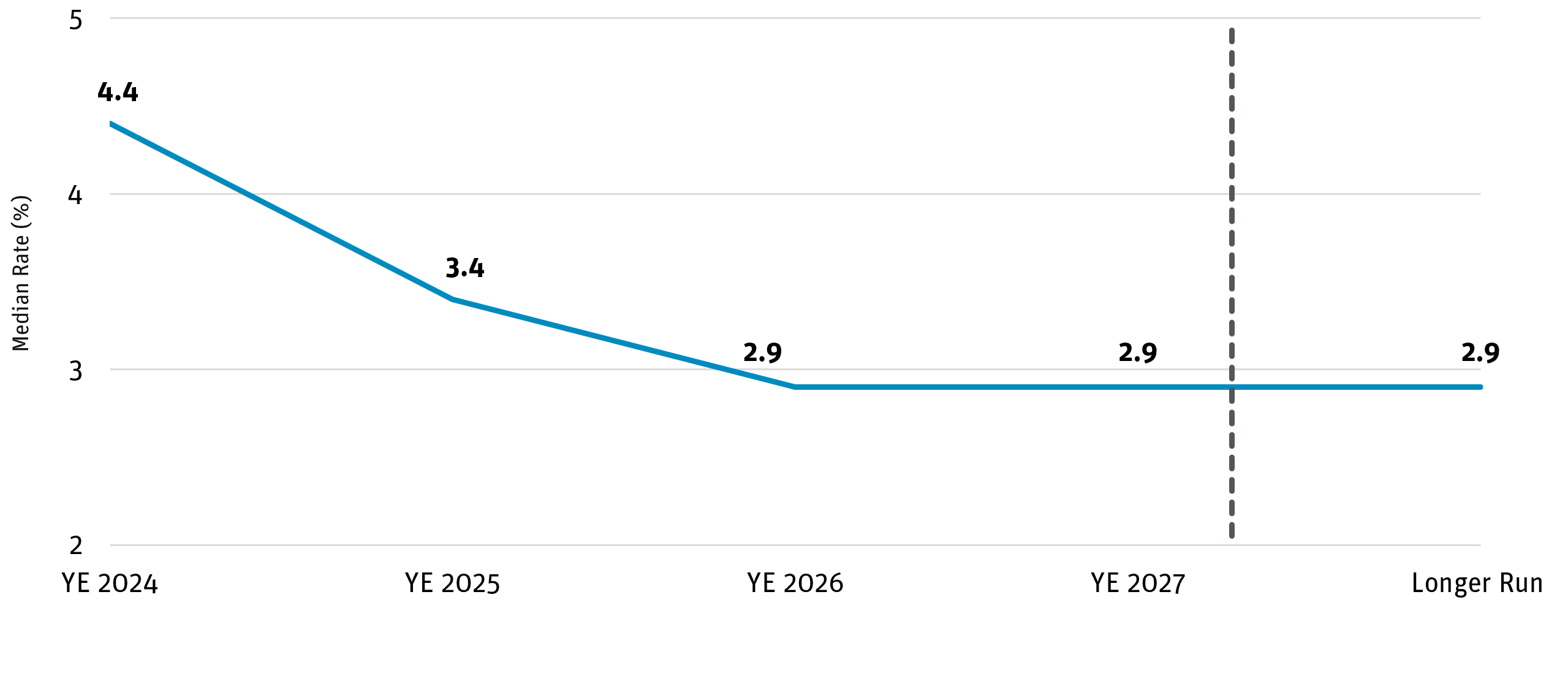

In addition to adjusting its key interest rate, the Fed updated economic projections for 2024 and the years ahead (Figure 2). The Fed’s target range for its short-term borrowing benchmark is now 4.75%–5.00%, and the projections imply policymakers expect 25 basis point cuts at each of the last two meetings this year, in November and December. By the end of 2025, policymakers anticipate a policy rate of 3.4%, according to their median projection, implying approximately 150 basis points lower than today’s range.

Figure 2: September 2024: FOMC Summary of Economic Projections for the Fed Funds Rate (Median Rate %)

Source: Federal Reserve as of 9/18/24.

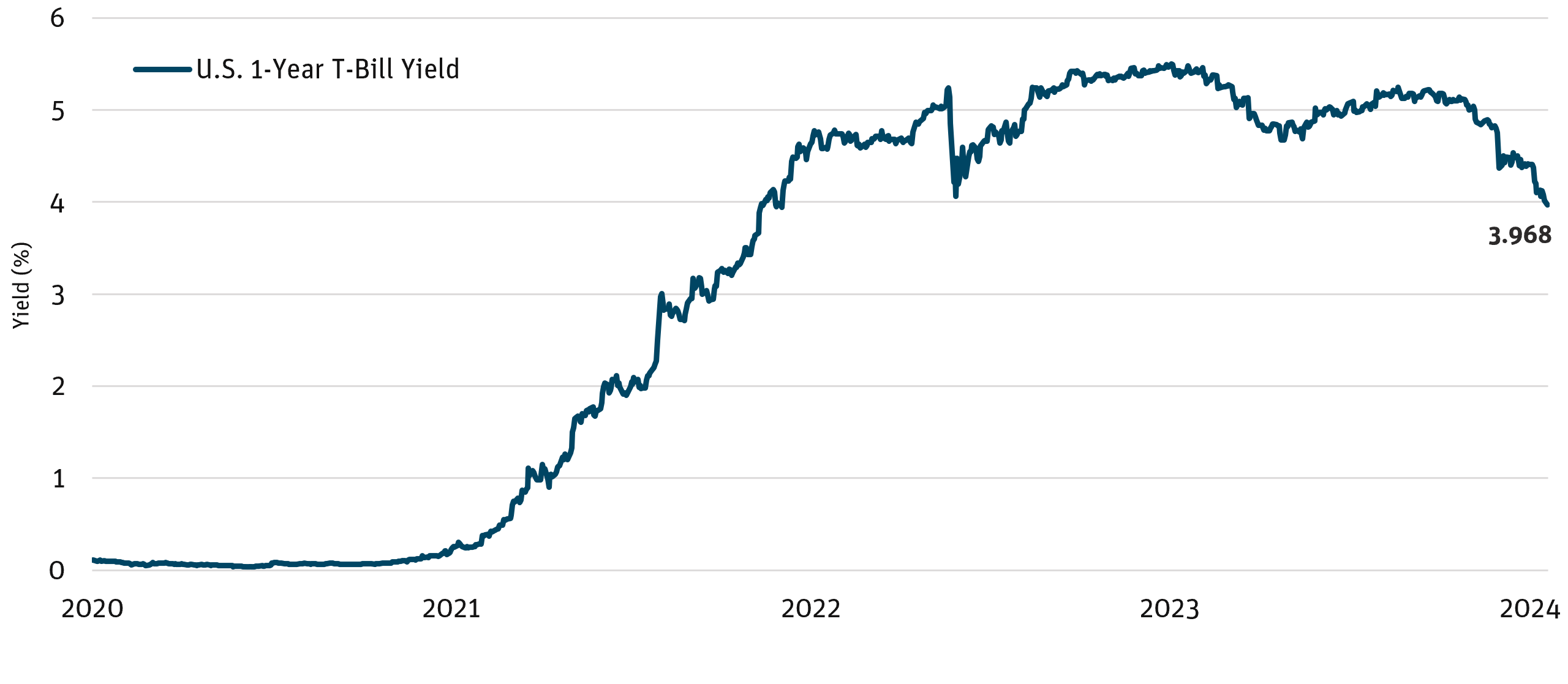

We think it continues to be a good time to reduce floating rate bonds to extend duration in advance of additional Fed rate cuts, particularly for clients who retreated into cash and money markets during the 2022– 2023 rate hiking cycle and have been earning a risk-free yield of 5% or more for over a year. While 2022–2023 was characterized by limiting interest rate risk, the next 12–24 months could look different. In our view, reinvestment risk has now become a larger concern than interest rate risk, and those elevated risk-free yields won’t likely last. We have already seen declines in 12-month government T-bills, breaching below 4% (Figure 3). Clients who remain in cash could miss out on what might be one of the most significant drivers of fixed income in recent history. Without duration, an investor will receive only coupon income from bonds, a fraction of the total return potential in fixed income.

Figure 3: U.S. 1-Year Government T-Bill Yield (%)

Source: Bloomberg as of 9/16/24.

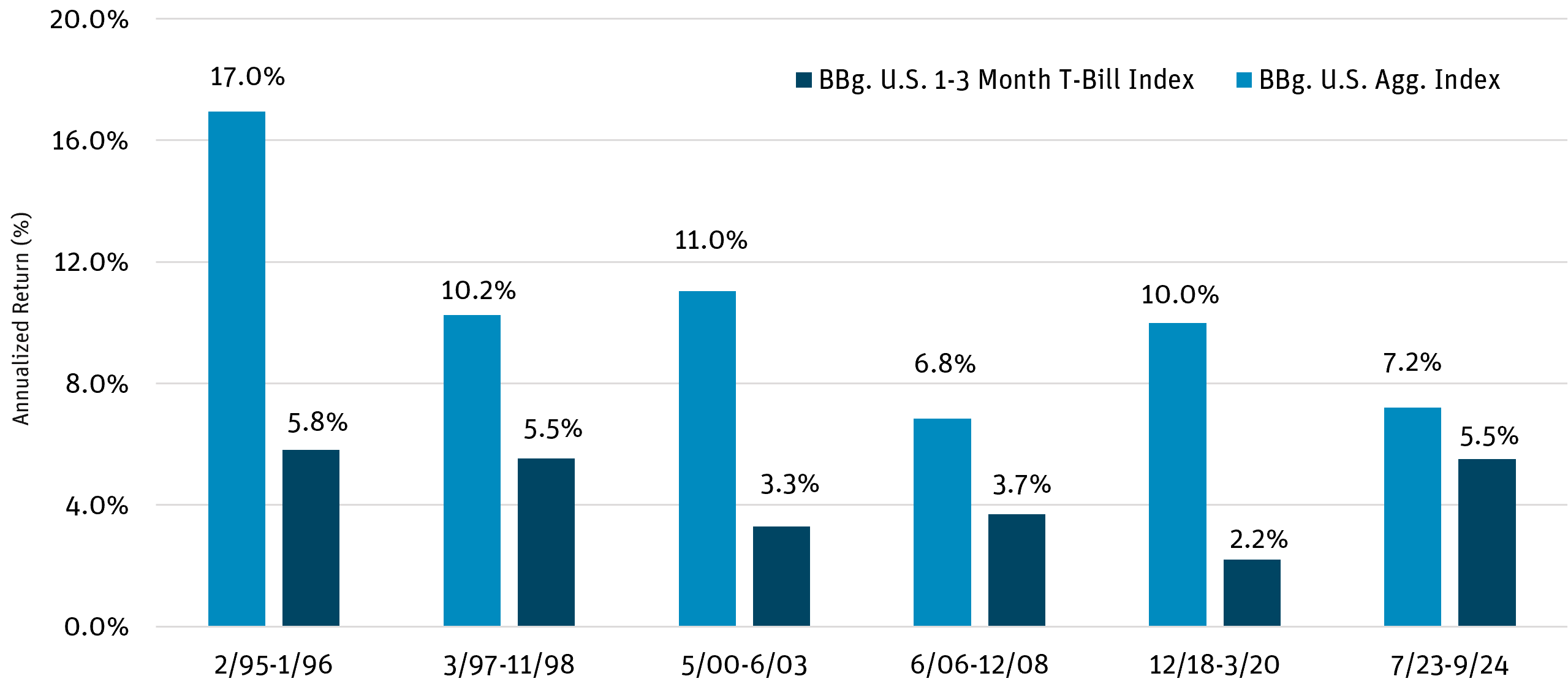

Short-term T-bills and money market funds traditionally outperform during hiking cycles. But when the Fed stops hiking (as in today’s market environment), longer-duration fixed income portfolios have historically outperformed, with the Bloomberg U.S. Aggregate Bond Index, outperforming the Bloomberg U.S. 1-3 Month T-Bill Index across multiple Fed cutting periods (Figure 4).

Figure 4: Annualized Returns: End of Hikes to End of Cuts (%)

Source: Bloomberg as of 9/16/24.

With rate declines expected over the course of the next year, high-quality fixed income portfolios of intermediate duration have the potential to generate total returns that are greater than current yields and to help mitigate reinvestment risk. Bond prices remain at historically attractive levels, and we believe this is an opportune time for investors to lock in today’s attractive yield levels and potential for greater price appreciation.

DEFINITIONS AND DISCLOSURES

Basis Point (bps): One hundredth of one percent and is used to denote the percentage change in a financial instrument.

Bloomberg U.S. Aggregate Bond Index: An unmanaged index that measures the performance of the investment-grade universe of bonds issued in the United States. The index includes institutionally traded U.S. Treasury, government sponsored, mortgage and corporate securities.

Bloomberg U.S. 1-3 Month Treasury Bill Index: Measures the performance of public obligations of the U.S. Treasury that have a remaining maturity of greater than or equal to 1 month and less than 3 months.

Consumer Price Index (CPI): An index that measures the changes in the price of a certain collection of goods and services bought by consumers in an effort to measure inflation.

Current Coupon: Refers to a security that is trading closest to its par value without going over par. In other words, the bond’s market price is at or near to its issued face value.

Duration: Measures a portfolio’s sensitivity to changes in interest rates. Generally, the longer the duration, the greater the price change relative to interest rate movements.

Federal Funds Target Rate: A target interest rate set by the central bank in its efforts to influence short-term interest rates as part of its monetary policy strategy.

Floating Rate: A floating-rate security is an investment with interest payments that float or adjust periodically based upon a predetermined benchmark.

FOMC Dot Plot: A chart summarizing the Federal Open Market Committee’s outlook for the federal funds rate. Each dot marks where a respective FOMC member expects the federal funds rate to be at the end of a particular period.

Spread: The difference in yield between a U.S. Treasury bond and a debt security with the same maturity but of lesser quality.

Yield Curve: The U.S. Treasury yield curve refers to a line chart that depicts the yields of short-term Treasury bills compared to the yields of long-term Treasury notes and bonds.

Opinions expressed are as of 9/18/24 and are subject to change at any time, are not guaranteed, and should not be considered investment advice.

Investing involves risk; principal loss is possible. Investments in debt securities typically decrease when interest rates rise. This risk is usually greater for longer- term debt securities. Investments in lower-rated and nonrated securities present a greater risk of loss to principal and interest than do higher-rated securities. Investments in asset-backed and mortgage-backed securities include additional risks that investors should be aware of, including credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Derivatives involve risks different from — and in certain cases, greater than — the risks presented by more traditional investments. Derivatives may involve certain costs and risks such as illiquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lead to losses that are greater than the amount invested. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. The Fund may use leverage, which may exaggerate the effect of any increase or decrease in the value of securities in the Fund’s portfolio or the Fund’s net asset value, and therefore may increase the volatility of the Fund. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are increased for emerging markets. Investments in fixed-income instruments typically decrease in value when interest rates rise. The Fund will incur higher and duplicative costs when it invests in mutual funds, ETFs and other investment companies. There is also the risk that the Fund may suffer losses due to the investment practices of the underlying funds. For more information on these risks and other risks of the Fund, please see the Prospectus.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Angel Oak Funds. This and other important information about each Fund is contained in the Prospectus or Summary Prospectus for each Fund, which can be obtained by calling 855-751-4324 or by visiting www.angeloakcapstg.wpengine.com. The Prospectus or Summary Prospectus should be read carefully before investing.

Index performance is not indicative of Fund performance. Past performance does not guarantee future results. Current performance can be obtained by calling 855-751-4324.

The Angel Oak Funds are distributed by Quasar Distributors, LLC.

© 2024 Angel Oak Capital Advisors, which is the adviser to the Angel Oak Funds.